Global stocks traded around all-time highs Wednesday as investors weighed the economic rebound from the pandemic and stimulus support. The dollar halted a four-day loss.

A gauge of Asia-Pacific equities fluctuated, as did U.S. and European futures. Chinese stocks underperformed while Japan advanced. Toshiba Corp. shares are poised to surge after the company received an initial buyout offer from CVC Capital Partners. The S&P 500 and Nasdaq 100 retreated overnight as volume on U.S. exchanges slipped below 10 billion shares for the first time this year.

Oil held above $59 a barrel amid optimism that economic expansion will pick up. The International Monetary Fund upgraded its global growth forecast while warning about a divergence between advanced and less-developed economies.

A global stock gauge is around unprecedented levels on expectations for continued central bank support and the strongest global expansion in at least four decades. Concerns about higher borrowing costs destabilizing the market have eased, with bond yields subsiding as traders pull their more-aggressive positioning for Federal Reserve policy tightening. Investors are awaiting the latest Fed minutes for clues about the outlook.

“Central banks are continuing to keep interest rates so low, so people are looking for some place to put their money where they can get a return,” Sarah Hunt, Alpine Woods Capital Investors associate portfolio manager, said on Bloomberg TV. “That’s also why you have stocks priced somewhat for perfection.”

U.S. labor-market data showed job openings rose to a two-year high in February, led by gains in some of the industries hardest hit during the pandemic, adding to signs of a strengthening American rebound.

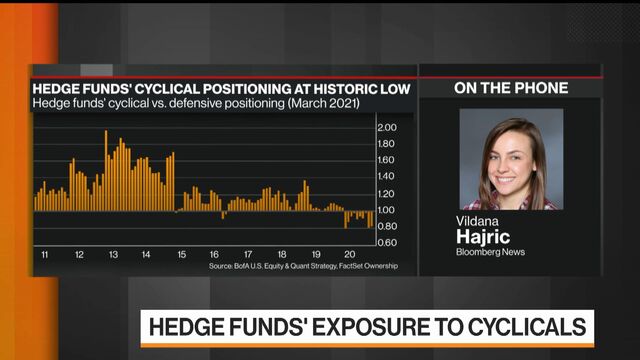

Despite a rally of at least 40% in energy and financial shares over the five months, hedge funds have steadfastly shunned stocks in the reflation trade, favoring instead companies seen as resilient during an economic slowdown.

Source: Bloomberg

Some key events to watch this week:

- The 2021 Spring Meetings of the IMF and the World Bank Group take place virtually. Federal Reserve Chairman Jerome Powell takes part in a panel about the global economy on Thursday.

- The Fed publishes minutes from its March meeting on Wednesday.

- Japan releases its balance of payments numbers Thursday.

- China’s consumer and producer prices data are due Friday.

These are some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 5 a.m. in London. The S&P 500 fell 0.1%.

- Japan’s Topix Index added 0.6%.

- Australia’s S&P/ASX 200 Index rose 0.4%.

- South Korea’s Kospi Index climbed 0.2%.

- Hong Kong’s Hang Seng Index fell 0.7%.

- China’s Shanghai Composite Index shed 0.5%.

- Euro Stoxx 50 futures were 0.1% lower.

Currencies

- The yen was at 109.78 per dollar.

- The offshore yuan was at 6.5444 per dollar.

- The Bloomberg Dollar Spot Index rose less than 0.1%.

- The euro traded at $1.1867, 0.1% lower.

Bonds

- The yield on 10-year Treasuries was at 1.66%.

- Australia’s 10-year yield fell two basis points to 1.76%.

Commodities

- West Texas Intermediate crude added 0.3% to $59.50 a barrel.

- Gold was at $1,738.27 an ounce, down 0.3%.

— With assistance by Lu Wang, Rita Nazareth, and Joanna Ossinger

"stock" - Google News

April 07, 2021 at 04:49AM

https://ift.tt/3rPO5Ww

Stock Market Today: Dow, S&P Live Updates for Apr. 7, 2021 - Bloomberg

"stock" - Google News

https://ift.tt/37YwtPr

https://ift.tt/3b37xGF

Bagikan Berita Ini

0 Response to "Stock Market Today: Dow, S&P Live Updates for Apr. 7, 2021 - Bloomberg"

Post a Comment