A quick glance at the annual returns of the S&P 500 over the last 10 years, and you'd think that investing in the stock market has been easy. However, plenty of ups and downs have demanded patience and a fair share of grit to get through.

There have been two major corrections in the last three years alone. Between Sept. 20, 2018 and Dec. 24, 2018, the S&P 500 plummeted 20%, mainly due to U.S.-China trade war fears. Between Feb. 19, 2020 and March 23, 2020, the S&P 500 plummeted 34% as the risks of the COVID-19 pandemic rippled through the market.

We can't control why the next market sell-off will happen or when it will occur. But we can make a game plan of what to buy when the time is right. Three Fool.com contributors selected Stepan (NYSE:SCL), FedEx (NYSE:FDX), and Illinois Tool Works (NYSE:ITW) as three industrial stocks worth buying if the market takes a turn for the worse.

Image source: Getty Images.

Better recession-readiness through chemistry

Scott Levine (Stepan): When looking to gird your portfolio against the stock market volatility that accompanies a recession, there are the usual suspects to consider -- utilities, gold stocks, etc. -- but one company that may not immediately pop into mind is Stepan, a leader in chemical manufacturing.

Supplying companies in a variety of industries, Stepan's diverse global customer base, which includes agriculture, oilfield, construction, and cleaning products, to name a few, ensures that its offerings remain in demand during an economic slowdown. Take the Great Recession, for example. From December 2007 through June 2009, shares of Stepan rose 45%, while the S&P 500 plummeted 38%.

The financial crisis wasn't the only economic downturn where Stepan proved its mettle. The company has been in business since 1932, so it's seen its share of ups and downs in the market, and it's still going strong. Over the past 53 years, in particular, Stepan has demonstrated its business fortitude in consistently raising its dividend, elevating its status to that of a Dividend King. In case investors unfamiliar with Stepan fear that its steadfast attention to its dividend would jeopardize its financial health, the fact that the company has averaged a 21.2% payout ratio over the past five years signals it can easily afford its quarterly payouts.

Should the economy take a turn for the worse, Stepan is well positioned to withstand the challenges that will emerge. The company, for example, has taken a conservative approach to leverage. As of the end of the second quarter of 2021, Stepan has a net debt-to-EBITDA ratio of 0.6.

People may take a pass on going out to dinner or skip updates to their wardrobes during a recession, but there's less of a chance that they'll stop using shampoo or washing the dishes at home -- illustrating the importance of Stepan's chemical products in our daily lives regardless of how the economy is faring.

This leading transportation stock is built to last

Daniel Foelber (FedEx): FedEx stock has been punished, sliding 13% in the last three months compared to an 8% gain in the S&P 500. The cause for concern could be because the company's forecast of 7% year-over-year revenue growth and 8% non-adjusted earnings growth for fiscal year 2022 looks weak relative to last year. But this diagnosis misses the forest for the trees.

Zooming out, it's clear to see that FedEx may just be in the best shape of its life. A big reason for that is because the company has grown the depth and breadth of FedEx Ground by expanding routes, focusing on e-commerce, and leaning into Sunday delivery -- all the while maintaining impressive profitability.

| Metric |

FY 2021 |

FY 2020 |

FY 2019 |

FY 2018 |

|---|---|---|---|---|

|

FedEx Ground average daily volume |

12,272 |

9,997 |

8,952 |

8,336 |

|

FedEx Ground percentage of total volume |

64.4% |

62.1% |

58.6% |

57.8% |

Data source: FedEx.

FedEx Ground delivery volumes finished fiscal year 2021 up around 50% from fiscal 2018, outpacing growth in Express and Freight. Higher Ground volumes are good news for FedEx's profitably because Ground has consistently sported a much higher operating margin than FedEx Express (and usually Freight).

|

Operating Margin |

FY 2021 |

FY 2020 |

FY 2019 |

FY 2018 |

|---|---|---|---|---|

|

Express |

6.7% |

2.8% |

5.9% |

5.8% |

|

Ground |

10.5% |

8.8% |

13.2% |

13.8% |

|

Freight |

12.9% |

8.2% |

8.2% |

7.2% |

Data source: FedEx.

Operating margin is the percentage of operating income relative to revenue. It's a useful profitability metric because it shows FedEx's ability to convert sales into profit. With a price-to-earnings ratio of just 13.7 and a dividend yield of 1.1%, FedEx is a value stock worth loading up on during a sell-off.

Blocking and tackling is enough to get the job done

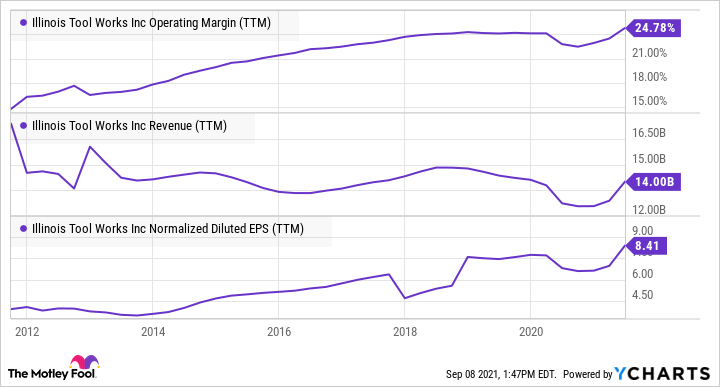

Lee Samaha (Illinois Tool Works): Illinois Tool Works has one of the best management teams in the U.S., and it has the numbers to prove it. Ever since Scott Santi took over as CEO in 2012, the company has been on a seemingly inevitable journey of rising profit margin. It's a trip that's led to a dramatic increase in earnings per share and a 390% increase in the share price over the last decade.

At its heart lies the application of its enterprise strategy initiatives based on refocusing its business and product lines on the 20% of its customers that tend to do 80% of its business, the so-called 80/20 principle. It may be simple blocking and tackling, but it's more than enough to generate bumper returns for investors.

Data by YCharts

Management also proved its worth during the COVID-19 pandemic. Instead of shedding workers in response to a slump in demand, Santi told his divisional leaders to be aggressive and plan for recovery and long-term growth after that. It's an approach that's worked as the economy came surging back in 2021. It's also indicative of management that understands its key asset is its people. The stock may not be a raging buy right now based on its valuation, but given any general stock market malaise, it's precisely the kind of company investors should be looking at buying into.

This article represents the opinion of the writer, who may disagree with the “official” recommendation position of a Motley Fool premium advisory service. We’re motley! Questioning an investing thesis -- even one of our own -- helps us all think critically about investing and make decisions that help us become smarter, happier, and richer.

"stock" - Google News

September 12, 2021 at 06:00PM

https://ift.tt/3ljMreq

3 Stocks Worth Buying During a Stock Market Sell-Off - Motley Fool

"stock" - Google News

https://ift.tt/37YwtPr

https://ift.tt/3b37xGF

Bagikan Berita Ini

0 Response to "3 Stocks Worth Buying During a Stock Market Sell-Off - Motley Fool"

Post a Comment