Elena Bionysheva-Abramova

The Q4 Earnings Season for the Gold Miners Index (GDX) has ended, and reserves & resource update season is well underway. One of the first companies to release its updated Reserve & Resource statement was Barrick Gold (NYSE:GOLD) which saw an increase in its total gold reserves for the second consecutive year, and it's set up to enjoy meaningful reserve growth per share given that several key assets are not currently in its reserve profile. Just as importantly, its shared majority-owned and shared Nevada operations look the best they have in a decade with continued exploration success, key additions to landholdings, and meaningful ounce growth since Barrick and Newmont (NEM) teamed up in Nevada. Let's dig into the report below:

Reserves

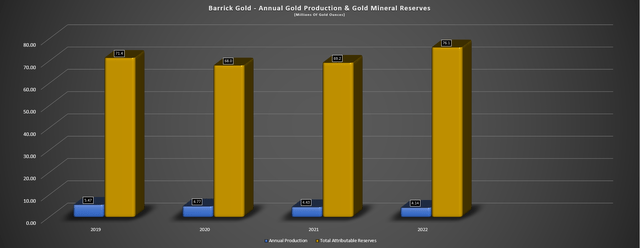

Barrick Gold released its FY2022 Reserve & Resource Update last month, reporting total attributable gold reserves of 76 million ounces at an average grade of 1.67 grams per tonne of gold. This compared favorably to 69 million ounces of mineral reserves (albeit grades dipped slightly from 1.71 grams per tonne of gold), with Barrick reporting a ~10% increase in reserves. The significant reserve growth marked the second consecutive year of increased reserves despite significant depletion (~4.14 million ounces of gold) and reserves have now hit a new high following the Randgold merger and Mark Bristow taking over as CEO of Barrick. Notably, the meaningful reserve growth was accomplished despite the following headwinds:

- divestment of Kalgoorlie that resulted in a loss of ~3.65 million ounces of gold

- divestment of Massawa that resulted in a loss of ~2.2 million ounces of gold

- reduced ownership of Porgera (24.5% vs. 47.5%) under the new agreement that resulted in a ~1.2 million ounce decline in gold reserves

The result is that, adjusted for divestments, the reserve growth is even more impressive, especially because Barrick has maintained a $1,300/oz gold price assumption, and hasn't chosen to pull up its figures to grow reserves on riskier mine plans like some peers, such as First Majestic (AG) which uses a $1,750/oz gold price.

Barrick Gold - Mineral Reserves & Annual Production (Company Filings, Author's Chart)

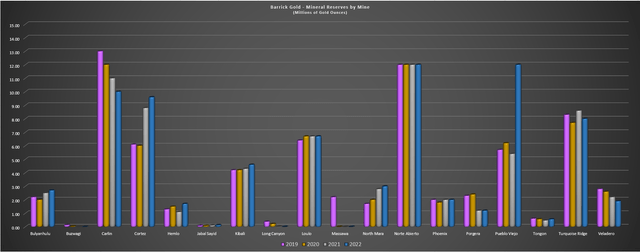

Digging into the mineral reserve growth by mine, we can see that the major increase in reserves came from the completed pre-feasibility study for the Naranjo tailings storage facility at Pueblo Viejo that add 6.5 million ounces of attributable reserves and extended the mine life into the 2040s. This is a massive mine capable set to produce over 800,000 ounces per annum (100% basis) at sub $1,000/oz all-in sustaining costs so the extension of reserves here is quite positive for both Newmont (40%) and Barrick (60%) given that it helps to pull down consolidated costs.

Elsewhere in the portfolio, Bulyanhulu saw another year of reserve growth (2.7 million ounces vs. 2.5 million ounces at year-end 2022), and Cortez (Robertson maiden reserve), Hemlo (new pushback), Kibali (underground FS on 11000 lode at KCD underground), and North Mara (underground expansion at Gokona) all increased reserves, with the most significant increase from a percentage basis at Hemlo. In Hemlo's case, reserves increased to 1.70 million ounces vs. 1.10 million ounces last year and 1.30 million ounces at the time of the acquisition. However, while this reserve growth net of depletion is impressive, it's important to note that there are multiple opportunities to grow reserves further that aren't included in the most recent update, as I'll highlight below:

Barrick Gold - Attributable Mineral Reserves (Company Filings, Author's Chart)

Nevada Resource Growth

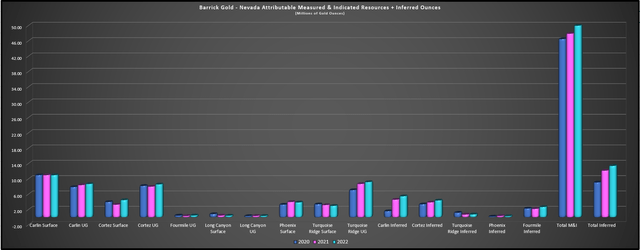

Digging into Barrick's Nevada operations (61.5% owner of Nevada Gold Mines LLC), the joint-venture expects to produce just over 3.2 million ounces of gold (100% basis) in FY2023 at industry-leading costs of $1,180/oz. Barrick's share of this production should come in at ~2.0 million ounces of gold, meaning that this is clearly an important set of assets for the company, especially given that it balances its less attractive jurisdictional profile in some other jurisdictions that investors may look on less favorably. Fortunately, exploration success at its Nevada operations has exceeded my expectations, with measured & indicated resources increasing from 46.5 million ounces in 2020 to 50.2 million ounces. Meanwhile, inferred ounces are up 47% in the same period to ~13.4 million ounces of gold.

Barrick Nevada - Attributable Resources (Nevada) (Company Filings, Author's Chart)

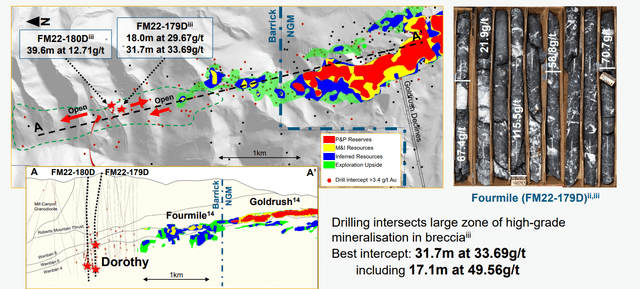

One key contributor to this resource growth is the company's Fourmile discovery made last decade which may have been missed if not for persistence testing the ground north of Goldrush given that the first 10 holes disappointed given the proximity to a major high-grade ore body (Goldrush). However, this changed with drill-hole 427, which hit 5.8 meters of 49.7 grams per tonne of gold and instilled hope that the company might uncover another high-grade deposit at the Cortez Complex. Since then, Barrick has proven up 0.50 million ounces in the indicated category at 10.01 grams per tonne of gold and an additional 2.7 million ounces in the inferred category at 10.5 grams per tonne of gold. This is especially valuable to Barrick, given that Fourmile is 100% owned and was separated during the creation of Nevada Gold Mines LLC.

Fourmile/Goldrush Exploration (Company Website)

In Barrick's most recent disclosures, it noted that mineralization continues to extend to the north at the Dorothy target (800 meters north of the Fourmile resource), with the best intercept at Dorothy hitting 31.7 meters at 33.69 grams per tonne of gold. This is an incredible intercept that is one of the best drilled sector-wide in 2022 among all gold producers on a gram-meter basis, and especially when adjusting for only holes above 10 meter widths. Another highlight intercept was 39.6 meters at 12.71 grams per tonne of gold. Barrick noted that this represented the most continuous zones of mineralization in this target area and that they "increase the potential at Dorothy as "the mineralization is observed at a lower horizon than previously tested in the target area and remains open in all directions."

Notably, both holes (FM22-180D and FM22-179D) also hit shallower mineralization along the Sadler Fault in what is a key structural control for the Fourmile resource to the south. These shallower intercepts included 18.0 meters at 29.67 grams per tonne of gold and 4.0 meters at 13.62 grams per tonne of gold, with both intercepts being well above the average grade of Fourmile and Goldrush. Regarding these holes, Barrick noted:

"these intercepts are beginning to establish a thicker and more continuous zone of mineralization along this key structure in the Dorothy area as well"

- Barrick Gold, 2022 Annual Report

Obviously, it's still early days for exploration at Dorothy, but it would be quite rare to see and there's no guarantee that this is a 2.0+ million-ounce extension north of Fourmile. However, it would be quite rare to see intercepts of this calibre this close to two major deposits that aren't continuous and this certainly points to the potential for Fourmile (with Dorothy) growing into a 5.0+ million ounce resource, especially given the grades which require little tonnes to add resource ounces. In summary, I see this as a very positive development for Barrick and this is just one deposit among its two largest mining complexes in Nevada.

Elsewhere at Cortez, Barrick is confident in future resource growth at extensions to Robertson (low-grade heap leach project) with additional targets including Distal, the gap between Gold Pan and Porphyry, and Altenburg Hill), and the company is also getting promising results from the Cortez Hills Underground Extension (Hanson Feeder). Highlight intercepts at Hanson include 24.7 meters at 6.67 grams per tonne of gold, 12.2 meters at 7.60 grams per tonne of gold, and 20.1 meters at 9.64 grams per tonne of gold, which are all mostly in line with or above the average reserve grade at Cortez Underground.

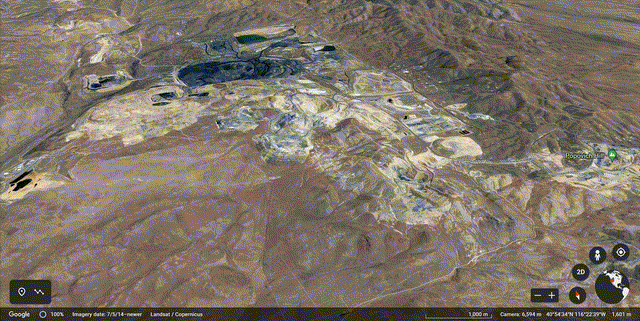

Carlin Complex, Nevada (Google Earth)

Finally, at the company's Carlin Complex (shown above), it's added key ground north of Goldstrike with the asset swap (Lone Tree for South Arturo and Rodeo Creek), and Barrick continues to see exploration success at REN (1.5+ kilometer Corona Corridor west of the bulk of its resource base), and results at the Leeville Complex are quite promising. These include a larger footprint at North Turf, continue resource growth at Rita K, world-class intercepts coming out of North Leeville like 57.7 meters at 28.39 grams per tonne of gold and impressive intercepts in the gap between North Turf and North Leeville. Meanwhile, Barrick has identified new targets at Horsham (east of Leeville Fault), and Little Boulder Basin (thick intervals of brecciation with overprinting hydrothermal sulfide veins at Golden Egg target).

So, while Barrick saw reserves decline at Carlin (10.0 million ounces vs. 11.0 million ounces) at an asset that is tough to replace reserves because of its immense annual production, there is reason to believe that Barrick will be able to adding back these depleted ounces given the exploration success at multiple targets. In fact, although reserves declined at Carlin year-over-year, underground M&I resources increased to 8.7 million ounces (FY2020: 7.9 million ounces), and inferred resources increased to ~5.6 million ounces, a 22% increase year-over-year. In summary, while it may not have shown up in reserves, there are reasons to be very optimistic about production at Carlin continuing into the 2040s like Pueblo Viejo.

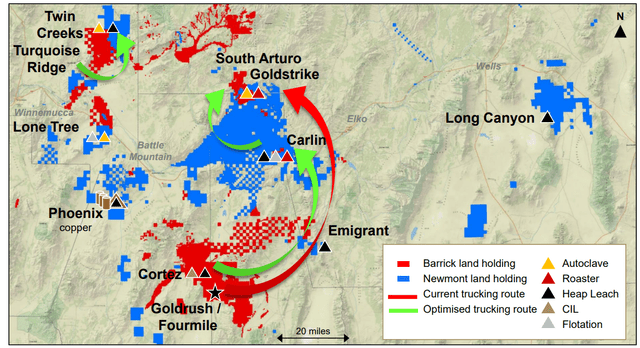

Three years ago, Newmont and Barrick made the strategic decision to combine their Nevada assets, a move that is clearly paying off. The obvious benefit was more optimized trucking routes, with the major one being hauling refractory ore a shorter distance from Cortez to Mill 6 (roaster) vs. the Goldstrike roaster previously (Goldstrike roaster at the north end of the Carlin Complex) and merging Twin Creeks and Turquoise Ridge into one complex. However, the other major benefit was the ability to take the borders off these assets from a geological standpoint and work together with a common goal to make new discoveries anywhere across the now shared land. The above exploration highlights suggest we're seeing a material benefit from this merger, and this has shown up in the life-of-mine plans for the Nevada Operations, which have improved considerably despite Long Canyon heading offline following the completion of Phase 1 mining.

Nevada Joint Venture Synergies (Company Presentation)

Nevada Joint Venture Synergies (Company Presentation)

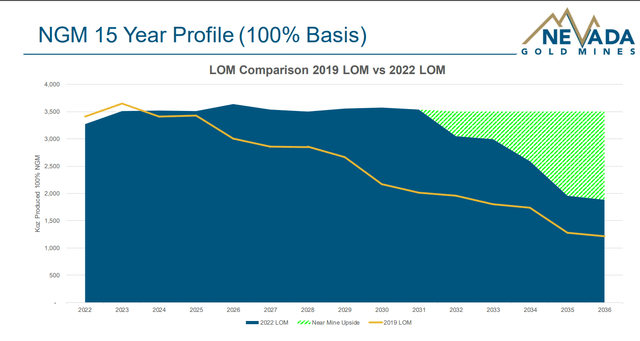

Nevada Gold Mines - 15-Year Production Profile (Company Presentation)

As for the fruits of this labor, Nevada Gold Mines' 2022 life-of-mine profile now expects to maintain production at ~3.5 million ounces of gold over the next eight years vs. a previous outlook (2019 life-of-mine) that suggested a steady decline in production starting in 2024 that could have hurt the multiple for both stocks given that this is their major contributor from a production and cash flow standpoint in a Tier-1 jurisdiction profile. Hence, the NGM JV couldn't have been more positive for both companies and, with the benefit of hindsight, the outlook for the operations would have been much less ebullient following two years of significant inflationary pressures that could have pushed costs above $1,400/oz if not for the benefit of synergies.

Putting It All Together

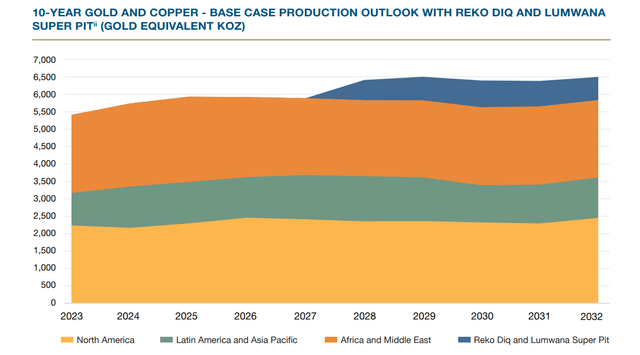

If we put it all together, Barrick Gold's 10-year production profile (gold-equivalent ounces) highlights a production profile of 5.5+ million GEOs per annum starting in 2024 with plans to maintain this production profile over the next decade, providing visibility into future cash flows. However, this is the base case, and if Barrick develops Reko Diq and the Lumwana Super Pit, we could see production head above of 6.5 million GEOs per annum, placing Barrick just behind Newmont as the world's largest gold producer and extending its lead vs. Agnico Eagle (AEM). So, while this is a depleting business and it's tough to bet on the majors given that they lack growth, hard work in the past few years has paved a brighter future for Barrick.

Barrick - Company-Wide Base Case Production Outlook (Company Presentation)

As for 2023, Barrick noted it expects to spend $180 million to $200 million on exploration and evaluation expenditures in 2023, roughly in line with FY2022 expenditures of $198 million. Besides this, Barrick plans to spend $220 million to $240 million in project expenses (FY2022: $152 million), with this related to work at Reko Diq in Pakistan, the Lumwana Super Pit Pre-Feasibility Study, and project evaluation costs in Latin America and the Asia-Pacific region (including Pascua-Lama). This exploration and project expenses budget is well above that of Agnico Eagle ($420 million vs. ~$330 million), which makes sense given that Barrick is a larger producer with two large growth projects that intends to investigate further: the Lumwana Super Pit and Reko Diq.

Valuation & Technical Picture

Based on ~1750 million shares and a share price of US$18.60, Barrick trades at a market cap of $32.6 billion, well below that of Newmont (NEM) and only slightly ahead of Franco-Nevada in the precious metals space. I continue to see this valuation as very reasonable for a company on track to produce ~4.4 million ounces of gold this year at industry-leading margins (sub $1,210/oz all-in sustaining costs) and an additional ~450 million pounds of copper. This is only slightly behind that of Newmont, the world's largest gold producer, and well ahead of Agnico Eagle (AEM) on a GEO basis given the declining production at LaRonde, Fosterville, Kittila, and Pinos Altos, which is partially offsetting the consolidation of the Canadian Malartic Mine in Quebec. Using a $4.00/lb copper price, Barrick's GEO profile for 2023 is ~5.4 million GEOs.

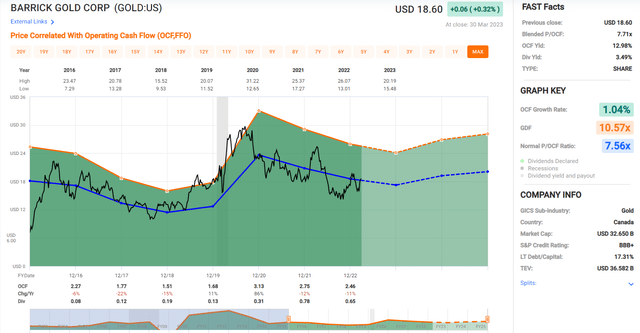

Barrick Gold - Historical Cash Flow Multiple (FASTGraphs.com)

Looking at Barrick from a cash flow standpoint relative to its historical multiples, the company is on track to generate upwards of $4.5 billion in cash flow, translating to cash flow per share of US$2.59. This leaves the stock trading at just ~7.2x cash flow vs. what I believe to be a fair multiple of 10.0x cash flow to reflect a much stronger portfolio (future of Nevada operations looks the best it has in a decade with synergies from NGM LLC), and a cleaner balance sheet than it had in the previous decade and ownership of multiple Tier-1 mines which separates it from most of its peers in the million-ounce producer space. Based on this 10.0x cash flow multiple and what I would consider being relatively conservative estimates of $2.59 if the gold price can hold up, I see a fair value for the stock of US$25.90.

While this represents a meaningful upside from current levels and investors could see an additional ~4% return if we assume a US$0.60 dividend paid this year (mix of Level I, Level II, and potentially Level III dividends) under its new performance dividend policy, I prefer a minimum 35% discount to fair value when buying large-cap producers, and Barrick doesn't quite meet that criteria today using a fair value of US$25.90. Instead, the stock would need to decline below US$16.85 to move back into a low-risk buy zone. So, while I am long the stock from US$16.25, I am not in a rush to add to my position this moment, and would only consider adding to my position on weakness (ideally below US$17.00).

Barrick Quarterly Chart (TC2000.com)

Finally, looking at the technical picture, Barrick's technical outlook has improved since my last update. This is because, while the stock undercut its uptrend line in Q3 and Q4, it could not muster up any lasting follow through above the highs of this range following its sharp reversal in February. However, the stock has since rebounded and looks to be on track to put together a quarterly close above its Q4 highs, a minor positive development. That said, the key from now on will be defending the US$16.00 level at all costs on a quarterly closing basis, given that a quarterly close below this trend line would put a severe dent in momentum.

That said, while we have seen a positive trend change recently and Barrick's moving averages are trying to play catch-up, the stock has an open gap at US$16.50 that may need to be filled and the stock is rallying above a declining 200-day moving average, which is not an ideal setup. This corroborates the view that while Barrick may be undervalued, chasing the stock above US$18.60 might not be the best idea. Instead, I see the more attractive setup being to wait for a sharp pullback to enter or top up one's position. Obviously, I could be wrong, and I am wrong all the time, but I see the better buying opportunity being US$16.80 or lower, even if this quarterly close is a step in the right direction following a shakeout below a major uptrend line.

Summary

Barrick Gold may have had a tough year operationally like many of its peers, but it posted solid reserve replacement for the second consecutive year. In addition, total mineral resources continue to grow, and there looks to be upside to reserves from Nevada (Fourmile, REN, Arturo, Robertson Extensions), and elsewhere in the world from Kibali, Lumwana, and Reko Diq. Combined with a shrinking share count related to Barrick's opportunistic share buybacks ($424 million spent in 2022), we should see an improvement in its reserve growth per share trend. However, I prefer to only put capital to work when the odds are stacked heavily in my favor, and while that was the case below US$16.00, I don't see a low-risk buying opportunity at this moment. Hence, patience looks to be the best course of action.

"stock" - Google News

April 02, 2023 at 09:15AM

https://ift.tt/dnW5hXm

Barrick Gold: Another Year Of Successful Reserve Replacement (TSX:ABX:CA) - Seeking Alpha

"stock" - Google News

https://ift.tt/E1BbdhG

https://ift.tt/kPuV3Mn

Bagikan Berita Ini

0 Response to "Barrick Gold: Another Year Of Successful Reserve Replacement (TSX:ABX:CA) - Seeking Alpha"

Post a Comment