Some combinations are hard to beat. Sun and beer, C-3PO and R2-D2, cream cheese and bagels – all work together in perfect unison. You can throw into that list high yielding dividend stocks and a cheap share price. In the stock market, that’s about as potent a combination you can get.

Why is that? Well, first off, you can’t really go wrong with dividend stocks. Investors have the potential to earn returns even if the share price goes down, which is not common elsewhere. And when the price does go down, the dividend yield actually goes up.

Keeping this in mind, we delved into the TipRanks database and identified two dividend stocks that are generating a substantial 9% yield. According to certain analysts, these stocks are currently trading well below their fair value, with potential for further gains. Let’s take a closer look.

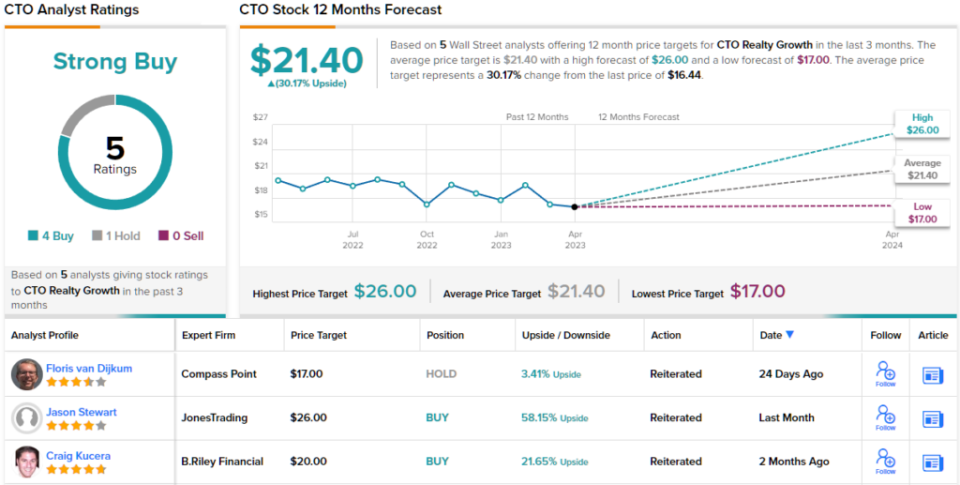

CTO Realty Growth (CTO)

Real estate investment trusts (REITs) are known for their high dividend yields, which makes them an ideal starting point. CTO Realty Growth owns and operates high-quality commercial real estate properties, primarily situated in thriving markets throughout the US. Additionally, the company holds a significant equity stake in Alpine Income Property Trust, generating a recurring flow of fees for CTO. The company’s approach involves acquiring properties below their replacement value and improving them to increase their worth.

It’s a blueprint that appears to be sound as throughout the entirety of the previous year, CTO achieved a growth of 26% in AFFO (adjusted funds from operations), amounting to a new company record. CTO also beat expectations in the most recently reported quarter – in the fourth quarter of 2022. Although revenue fell by 8.8% to $22.53 million, the figure still exceeded the forecast by $1.56 million. Q4 AFFO of $0.37 also exceeded the consensus estimate of $0.36.

However, investors were disappointed with the outlook, which due to possible near-term headwinds to same-property NOI (net operating income), came in below consensus expectations.

Although the shares have experienced a downturn, investors can still benefit from the attractive dividend. The current payout stands at $0.38, boasting a robust yield of 9.2%.

For JonesTrading analyst Jason Stewart, the shares’ retreat offers an opportunity for investors.

“We remain constructive on the portfolio and believe there is significant upside to current trading levels,” Stewart wrote. “CTO shares remain substantially discounted relative to peers based on traditional valuation metrics and exclusion of growth from capital recycling opportunities. CTO trades at a 31% discount to our $25.93 1Q23 NAV estimate…”

Quantifying this stance, Stewart rates CTO shares a Buy and backs it up with a $26 price target. The implication for investors? Upside of 58% from current levels. (To watch Stewart’s track record, click here)

Most on the Street agree with Stewart’s assessment; one fencesitter aside, all 4 other recent reviews are positive, providing this stock with a Strong Buy consensus rating. The forecast calls for 12-month returns of 30%, considering the average target presently sits at $21.40. (See CTO stock forecast)

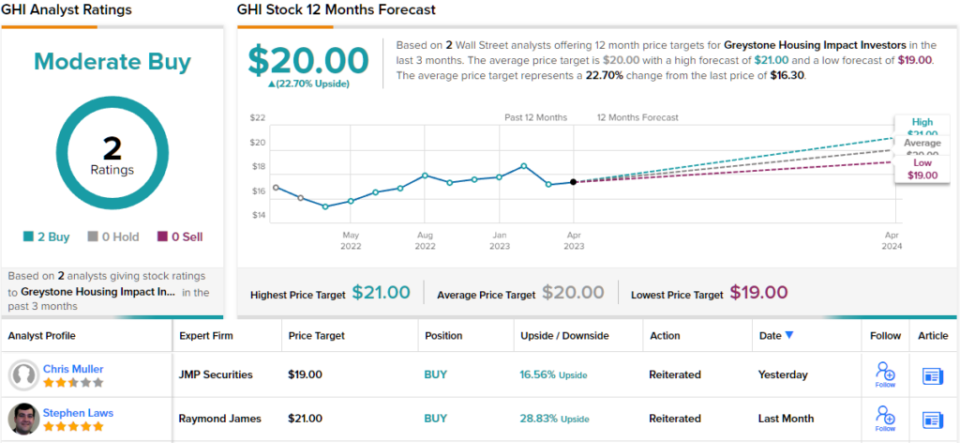

Greystone Housing Impact Investors (GHI)

Moving on, we have Greystone Housing Impact Investors, a real estate finance firm that specializes in investing in loans for various types of real estate, including affordable multifamily housing, student housing, and commercial assets. Their focus is on providing construction and/or permanent financing for these types of properties. GHI makes investments in direct ownership, preferred stock, government issuer loans (GILs), and mortgage revenue bonds (MRBs).

The company was established in 1998 but recently underwent a rebrand, changing its name from America First Multifamily Investors to the current one, last December.

Following that event, in January, the company collected proceeds from the sale of assets, namely, Vantage at Stone Creek and Vantage at Coventry, both based in Omaha, Nebraska, for a total of $27.7 million. The Partnership will see a gain from the sale of $15.2 million in Q1.

That said, the release of Q4 numbers in February failed to please investors. Although revenue climbed by 10.3% year-over-year to $22.03 million, the figure fell short of consensus by $2.02 million. The company delivered net income of $0.09 per Beneficial Unit Certificate (BUC) – the equivalent to EPS – but that missed the forecast by $0.03.

Nevertheless, what’s appealing here is obviously the juicy dividend. The company announced a payout of $0.37 per BUC in mid-March (to be paid on April 28) and that generates a hefty 9%.

While the shares have mostly been in retreat mode since the last earnings report, Raymond James analyst Stephen Laws thinks the low price presents a favorable chance for investors to take advantage of.

“We believe the recent selloff presents a buying opportunity, and we are reiterating our Outperform rating, which is based on the unique investment focus, attractive portfolio returns, potential gains on future Vantage sales, and the attractive valuation relative to our target,” said the 5-star analyst.

That price target stands at $21 and should it be met, will pocket investors returns of 29% a year from now. (To watch Laws’ track record, click here)

Only one other analyst has recently chimed with a GHI review but like Laws, they hold a positive stance, making the consensus view here a Moderate Buy. Considering the average target comes in at $20, the shares are expected to appreciate ~23% in the months ahead. (See GHI stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

"stock" - Google News

April 20, 2023 at 08:46PM

https://ift.tt/3XgfbQB

These 9%-Yielding Dividend Stocks Are Too Cheap to Ignore, Analysts Say - Yahoo Finance

"stock" - Google News

https://ift.tt/UyTRiB0

https://ift.tt/mtd82HT

Bagikan Berita Ini

0 Response to "These 9%-Yielding Dividend Stocks Are Too Cheap to Ignore, Analysts Say - Yahoo Finance"

Post a Comment