There’s no way around it, artificial intelligence (AI) looks set to play an increasingly big role in our daily lives and Nvidia (NVDA) has positioned itself at the forefront of this revolution.

The chip giant’s pivot to all things AI was already well-known and has only been further confirmed by the announcements made at the company’s semi-annual GTC happening.

Deutsche Bank’s Ross Seymore logged into the online event and came away impressed. “The company highlighted how it is well-positioned to enable AI adoption across an ever-broadening array of end markets utilizing a similarly widening number of technologies (GPUs, CPUs, DPUs, I/O, etc.) and go-to-market offerings (semis, hardware, software, services, on-prem, cloud, etc.),” the 5-star analyst explained. “In general, NVDA’s GTC presentations highlighted not only the rapidly broadening applicability of AI, but also the company’s unique ability to address this accelerating demand.”

Moreover, Seymore notes that Nvidia’s CFO pointed to the growing demand over the past month or so for AI compute, a positive development when compared to the outlook offered by the company on its last earnings call. Seymore also considers the announcements around the cloud-based service offerings as one of the event’s highlights, with DGX Cloud enabling enterprises to teach and then operate a broad range of current and emerging AI workloads.

The company does not consider this segment to be competing with its clients’ present Cloud offerings, but more as compatible with and set apart from current cloud service options, with the “greenfield opportunity” in this market trumping the worries over market share.

Elsewhere, on the more bread-and-butter semis/hardware side, NVDA reiterated its position that Grace will be aimed towards more specialized applications (AI, HPC, single threaded workloads), rather than set up to compete with general-purpose x86 CPUs.

Seymore makes it clear he is a fan of all the goings on at Nvidia, calling the combination of its leading position and the “momentum of generative AI adoption” as obvious tailwinds, however, there is a problem – one of valuation. “We believe much of this goodness has already been reflected in NVDA’s share price, now trading at a ~15%/35% premiums to company’s 3/5yr averages,” he noted.

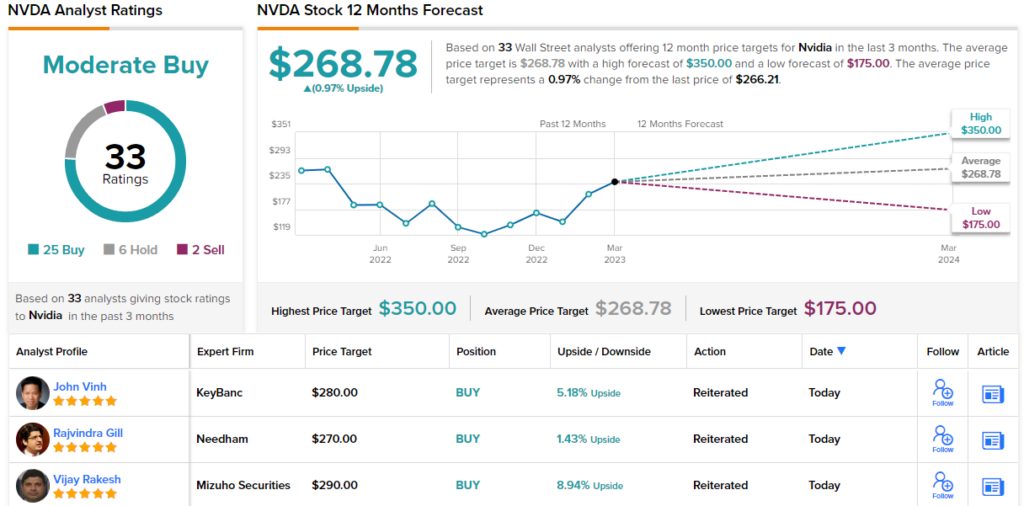

That said, although Seymore sticks with a Hold (i.e., Neutral) rating, he bumped the price target up to $220 from the prior $200. Nevertheless, there’s still downside of 17% from current levels. (To watchSeymore’s track record, click here)

5 other analysts join Seymore on the sidelines, and 2 others recommend staying away but with an additional 25 Buys, the stock claims a Moderate Buy consensus rating. The $268.78 average target suggests the shares are currently trading at their fair value. (See Nvidia stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

"stock" - Google News

March 22, 2023 at 08:46PM

https://ift.tt/DcFu1Bn

Nvidia Stock: GTC Confirms the AI Opportunity, but the Goodness Is Priced in, Says Deutsche Bank - TipRanks

"stock" - Google News

https://ift.tt/s0u8vN6

https://ift.tt/4i3fXa7

Bagikan Berita Ini

0 Response to "Nvidia Stock: GTC Confirms the AI Opportunity, but the Goodness Is Priced in, Says Deutsche Bank - TipRanks"

Post a Comment