Justin Sullivan

My Updated Thesis

The last time I wrote about SoFi Technologies, Inc. (NASDAQ:SOFI) was on January 16, 2023, when I rated the stock a Buy based on the results of my valuation models. At the time, my models showed an upside potential of 30-50% at the then $5.45 per share price, and my technical analysis showed an immediate target of +15% in the near term. As time has shown, SOFI stock literally closed its undervaluation gap within the next 2 weeks of the publication of that article, having gained >48% in such a short period. The stock then ran into trouble and eventually lost all of its accumulated gains, falling 9% below the publication price of my first article:

Seeking Alpha, my previous article on SOFI stock

Following the release of the company's financial statements for Q1 FY2023, the downward trend worsened - investors raised questions about slowing revenue growth, and the subsequent Wedbush analyst research report questioning SOFI's failure to mark-to-market its portfolio ultimately pushed the stock closer to its all-time lows.

In my opinion, the recent sell-off makes the stock undervalued again, but the upside potential now looks much bleaker than before because of the uncertainty around SOFI and in the fintech industry in general. However, as the calculated price target is above +15%, I reiterate my previous buy recommendation for SOFI.

Why Do I Think So?

Wedbush analyst Chiaverini stated on May 15 that he believes SoFi has reached a tipping point in capturing fee income from loan origination and disposition. He's concerned about the possible overcapitalization due to fair value accounting and suggests that SoFi could raise capital, diluting current shareholders, in case it can't reach profitability by the end of FY2023. Applying LendingClub's accounting model would reduce SoFi's tangible book value by approximately 60%. While SoFi isn't expected to change its accounting methodology, regulators may recommend a more conservative capital requirements framework in the future. So Wedbush cut its price target to $2.50 from $5 per share - that's a 50% downside to the close price as of May 17, 2023.

Not all analysts agreed with this formulation of the question. The well-known Dan Dolev, an MD of Mizuho Securities, recommended buying this dip and countered Wedbush's thesis. First, he disagrees with the view that SoFi cannot sell loans. Dolev claims that SoFi made the strategic decision to keep the loans on its balance sheet because it can earn a better yield by doing so. He argues that SoFi earns about 6.4% by holding the loans compared to selling them for 5%. Second, Dolev addresses the idea that SoFi's accounting could change. He clarifies that once an accounting method is chosen, in this case, fair value accounting, it cannot be changed (regulators don't allow switching between fair market value and cost accounting). Finally, he addresses the disclosure of SoFi's potential liquidity needs, pointing out that this isn't new information, but has already been disclosed in S-1 or 10K filings. He feels that there is nothing new to be concerned about in this regard.

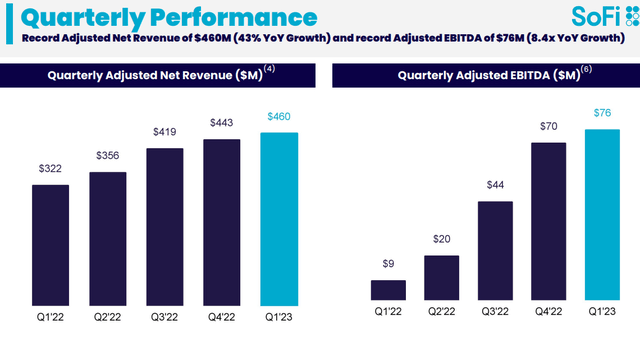

If we look at the most recent quarter's financials, almost everything looks quite solid for SOFI, as far as I see it. During Q1, the company reported a new record in adjusted net revenue at $460 million, marking a 43% YoY increase. Their lending and financial services segments performed exceptionally well, contributing to this strong revenue growth. SoFi also achieved a record adjusted EBITDA of ~$76 million, with a 48% incremental margin and a 16% margin overall. Notably, they achieved a positive GAAP net income margin of 54%, resulting in a loss of only $34 million.

SOFI's Q1 IR materials

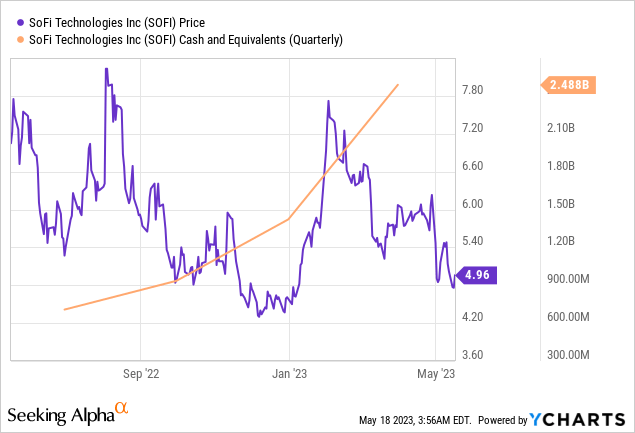

SoFi's deposit base surpassed $10 billion, with a sequential growth of $2.7 billion in the quarter. The CEO - Anthony Noto - highlighted during the earnings call that over 90% of consumer deposits come from direct deposit members, with 97% of deposits insured. Their cash and cash equivalents on the balance sheet increased by $1.1 billion to $2.5 billion since year-end, significantly strengthening their liquidity position.

Overall, SoFi experienced robust growth in its member base, adding 433,000 new members in Q1, totaling nearly 5.7 million, a 46% YoY increase. They also expanded their product offerings, adding 660,000 new products and reaching a total of 8.6 million, a 46% YoY increase. Financial Services products grew to 7.1 million, reflecting a 51% YoY increase, while lending products totaled 1.4 million, a 24% YoY increase. SoFi's CEO emphasized their ability to adapt quickly, such as expanding FDIC insurance capabilities and providing reassurance to members during the recent banking crisis.

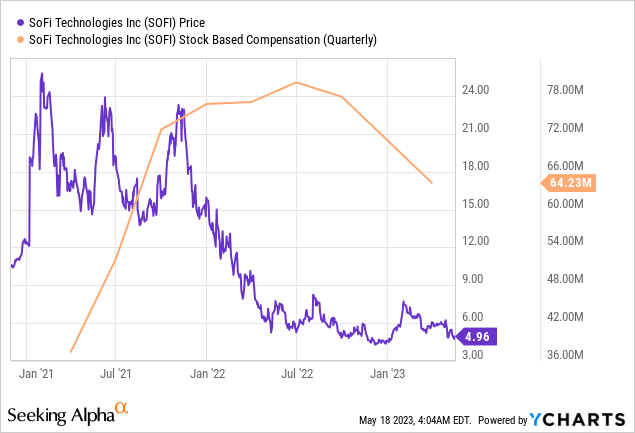

Stock-based compensation expenses also went down, as I expected previously:

In general, I view the operational changes positively - in many ways they have exceeded my own expectations. So I decided to update my DCF model based on the FCFE forecast rather than the FCFF forecast - I described in more detail in my last article what the difference is between these two cash flow streams.

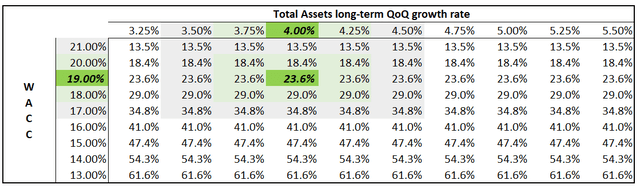

Let's assume that SOFI will indeed be GAAP profitable in Q4 FY2023 because the latest trends in horizontal financial analysis say just that (as well as management's hints). I project that the company will have an ROE of 10% by the end of 2028, with total assets growing with a CAGR of ~3.8% quarter-over-quarter, which is well below the growth rate of the last 11 quarters (CAGR of 9.75%, also QoQ). SOFI's common equity (as a share of total assets) has been steadily declining since September 2021 - I'll continue this trend in my model by assuming a QoQ decline of 0.8% and gently transitioning to 0.4% by the end of the forecast period.

FCFE is calculated as net income for the forecast period minus the change in common equity. Instead of WACC, I use my own model that accepts the SBC as an additional cost of capital input in addition to the classical parameters of the CAPM. So for SOFI, the cost of equity would be 19%, which is a lot, I know - but this rate captures most of the risks associated with investing in this firm. So the net present value of the projected FCFEs is $3.2 billion. Last time I used two times the final FCFE to calculate the terminal value, but this time I'll just use 1x.

What result do I arrive at?

Author's work

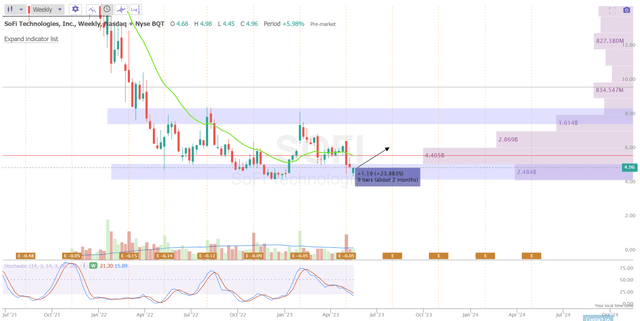

In the short term, the intrinsic upside potential I've calculated brings SOFI stock back to the middle of the price range formed, but I don't rule out the need for further confirmation.

TrendSpider Software, author's notes

The Bottom Line

Looking at the company's guidance and actual financial results, and looking at Dan Dolev's rebuttals, I suspect that much of the pessimism about SOFI is due to the comments of individual analysts. Yes, there are definitely questions about what will happen to the company's portfolio if it marks to market. But apparently, it may not do this. Further dilution is a serious risk for investors, but my model shows that SOFI stock is still undervalued if we add a few extra percent to the cost of equity when calculating FCFE. Yes, this time my model wasn't as generous to SOFI as it was in mid-January 2023 - that's mostly due to my gloomy forecasts for the change in common equity as a percentage of total assets. However, the results still show an undervaluation that is above my 15% Buy rating threshold - so I'm confirming it today.

It's important to keep in mind, however, that nothing is stopping SOFI stock from extending its undervaluation - the sentiment is quite negative at the moment and there is no clear confirmation of a turnaround yet. All potential investors need to know the opposite view than the one I've outlined today - click here for more Seeking Alpha's Analysts' views. And the most important thing is to do your due diligence before buying.

Thank you for reading! Please, let me know what you think in the comment section below!

"stock" - Google News

May 19, 2023 at 02:35AM

https://ift.tt/U4uIZWD

SoFi Technologies Stock: Consider Buying This Dip (NASDAQ:SOFI) - Seeking Alpha

"stock" - Google News

https://ift.tt/hEWpwXz

https://ift.tt/TgUpzPw

Bagikan Berita Ini

0 Response to "SoFi Technologies Stock: Consider Buying This Dip (NASDAQ:SOFI) - Seeking Alpha"

Post a Comment