Most Asian stocks retreated Wednesday amid doubts over the timing of a spending package from Washington and some position-trimming in high-flying sectors. The gold selloff entered a second day after it tumbled the most in seven years Tuesday.

Shares fell in Shanghai, Sydney, Hong Kong and Seoul, and European futures pointed lower. Japanese stocks bucked the trend. S&P 500 contracts fluctuated after the benchmark fell for the first time in eight trading sessions Tuesday as investors sold some of the rally’s biggest winners. Some traders cited comments from Senate Majority Leader Mitch McConnell saying stimulus talks are at a stalemate as a catalyst for the declines. Treasury yields held their overnight rise. The dollar pushed higher against its major peers.

Elsewhere, the New Zealand dollar tumbled after the country’s central bank said it would boost its large-scale asset-purchase program as it kept the benchmark interest rate unchanged. New Zealand’s main stock gauge had earlier fallen after evidence of new coronavirus cases in the country forced fresh restrictions. Crude oil edged up.

Investors are considering the possibility that a stalemate in Washington could significantly delay the U.S. virus rescue package, weighing on the nascent recovery. Meanwhile, the massive rally in gold that sent the haven metal to record highs above $2,000 an ounce reversed course Tuesday, as a rise in bond yields cut into the negative real rates that had supported the metal.

We are seeing some portfolio switching “given the constant flurry of concerns about crowded positioning and stretched valuations in growth sectors such as tech and communication services,” said Matthew Sherwood, head of investment strategy for multi-asset at Perpetual Investment. “Value and cyclicals continue to be supported by positive economic surprise momentum.”

Meanwhile, Joe Biden chose Senator Kamala Harris as his running mate, betting that her ties to the African-American community and self-branding as a “progressive prosecutor” will help propel him to the White House. On the virus front, California reported a sharp jump in cases.

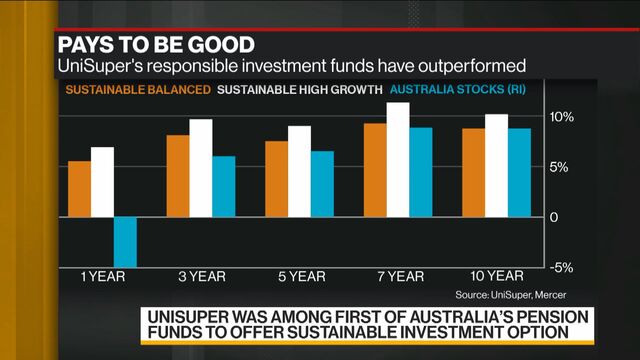

John Pearce, chief investment officer at UniSuper Management Pty Ltd., one of Australia’s largest pension funds, discusses finding opportunities in Tech with such high valuations, his investment in bonds and how gender equality influences assets.

Source: Bloomberg

Here are some key events coming up:

- Earnings include E.ON, Deutsche Telekom, Carlsberg, Tencent and JD.com.

- New Zealand’s central-bank policy decision is due on Wednesday.

- U.S. CPI for July is scheduled for Wednesday.

- China releases a slew of data for July on Friday, including industrial production and retail sales.

These are the main moves in markets:

Stocks

- Futures on the S&P 500 were little changed as of 12:01 p.m. in Hong Kong. The index fell 0.8% on Tuesday.

- Japan’s Topix Index rose 1.2%.

- Hong Kong’s Hang Seng lost 0.2%.

- Korea’s Kospi Index fell 0.1%.

- Shanghai Composite Index fell 2%.

- Australia’s S&P/ASX 200 Index dipped 0.4%.

- New Zealand’s S&P/NZX 50 fell 1.5%.

- Euro Stoxx 50 futures declined 0.5%.

Currencies

- The yen fell 0.3% to 106.76 per dollar.

- The offshore yuan fell 0.1% to 6.9495 per dollar.

- The euro dropped 0.2% to $1.1720.

- The Bloomberg Dollar Spot Index climbed 0.2%.

- The kiwi dropped 0.5% to 65.47 U.S. cents.

Bonds

- The yield on 10-year Treasuries rose two basis points to 0.66%. It rose more than six basis points Tuesday.

- Australia’s 10-year bond yield rose more than four basis points to 0.91%.

Commodities

- Gold was at $1,886.33 an ounce, down 1.3%.

- West Texas Intermediate crude was 0.4% higher at $41.78 a barrel.

— With assistance by Claire Ballentine, Katherine Greifeld, Joanna Ossinger, Ravil Shirodkar, and Michael G Wilson

"stock" - Google News

August 12, 2020 at 04:42AM

https://ift.tt/2PIdGjl

Stock Market Today: Dow, S&P Live Updates for Aug. 12, 2020 - Bloomberg

"stock" - Google News

https://ift.tt/37YwtPr

https://ift.tt/3b37xGF

Bagikan Berita Ini

0 Response to "Stock Market Today: Dow, S&P Live Updates for Aug. 12, 2020 - Bloomberg"

Post a Comment