Still way too much wild craziness, including the ultimate bag-holder gamble: Why the bottom isn’t anywhere near.

By Wolf Richter for WOLF STREET.

I went out looking for blood in the streets Friday evening after the sell-off to see if markets had hit bottom, but there wasn’t any blood. There was instead chatter about the next rally, about what to buy and when. And there was the relentlessly exuberant pump-and-dump meme-stock crowd hoopla-ing DVD rental company Redbox Entertainment, one of the infamous SPACs, and video-streaming service Chicken Soup for the Soul Entertainment, which is going to acquire Redbox, in an utterly ridiculous crazy-wild game with a deadline (we’ll get there in a moment).

That this game is even played – that this utter nuttiness in the markets continues – indicates that there is still way too much exuberance, way too much liquidity, way too much craziness. And the bottom isn’t in until this kind of craziness is snuffed out.

It took 12 years of money printing and interest rate repression to inflate this Everything Bubble, and it’s going to take years to unwind it.

But markets are making some progress.

The S&P 500 index fell 2.9% on Friday, and 5.1% for the week, the biggest weekly drop since January. Closing at 3,901, the index is down 19% from its January high and is right back at the 52-week closing lows of May 19 and May 20. Monday is going to be interesting: A bounce, or the beginning of the next leg down.

The Nasdaq Composite fell 3.5% on Friday, and 5.6% for the week. At 11,340, it is down 30% from its November high. Its closing low occurred on May 24 at 11,264. Still not there yet.

Even Exxon, which soared along with other energy stocks for months, fell 1.9% for the day, the second day in a row of declines.

Initial bloodletting among the tech and social media giants.

Apple fell 3.9% for the day and 6.8% for the week, is down 25% from the January 3 high, and is closing in on its 52-week low.

Microsoft fell 4.5% for the day and 7.0% for the week, to its 52-week closing low, matching its May 20 close, and is waiting for further instructions on Monday.

My admiration, in terms of executing perfect market timing, goes out to CEO Satya Nadella who’d sold 50% of this Microsoft shares in one day, on November 22, 2021, $285 million in total, thereby nailing the peak in Microsoft shares, which have since then plunged by 27.6%, and nailing the peak of the Nasdaq Composite. Saved him $78 million.

Amazon, despite the 20-for-1 stock split and the large-scale financial engineering project of buying back $10 billion of its shares with borrowed money, fell 5.6% on Friday, and 12.5% for the week, but remained a tad above its two-year low of May 24.

Meta, which is betting its virtual farm on the metaverse and has ditched “Facebook” from everything it can, including in its name and stock ticker, fell 4.6% for the day and 9.5% for the week, and is down 54% from its high, and at $175.57 is right back where it had been in December 2017.

Tesla dropped 3.1% on Friday and 5% for the week, and is down 44% from its November high. Friday evening, it said that it would split its stock 3-for-1, and given the damage that Amazon has suffered since its stock-split announcement, this one is going to be interesting.

That’s another sign: As long as these stock splits are still going on, the market is far from having hit the bottom.

Among the other standouts is Intel, which dropped below $40 on Friday, its lowest closing price since October 2017.

| $ | Friday | from high | ||

| Apple | [AAPL] | 137.13 | -3.9% | -25.0% |

| Microsoft | [MSFT] | 252.99 | -4.5% | -27.6% |

| Amazon | [AMZN] | 109.65 | -5.6% | -41.9% |

| Alphabet | [GOOG] | 2228.55 | -3.0% | -26.7% |

| Meta | [META] | 175.57 | -4.6% | -54.3% |

| Tesla | [TSLA] | 696.69 | -3.1% | -44.0% |

| Nvidia | [NVDA] | 169.74 | -5.9% | -51.0% |

| Netflix | [NFLX] | 182.94 | -5.1% | -73.9% |

| Salesforce.com | [CRM] | 178.45 | -6.0% | -42.8% |

| Intel | [INTC] | 39.18 | -2.1% | -42.7% |

Everything Bubble began deflating in February 2021, it was just hard to see.

The S&P 500 started deflating after its high on January 3, 2022. The Nasdaq started deflating on November 23, the day after Microsoft’s CEO dumped half his Microsoft shares.

But the IPO and SPAC stocks, and assorted other stocks, that had been the biggest and most ridiculous highfliers – and the funds and indices that track them – started deflating in February 2021, with many stocks cratering 70%, 80% and over 90% in a matter of weeks and months, so that by March 2021, I mused, Was That the IPO Stocks Bubble that Just Popped? And it was. And I started collecting stories for my Imploded Stocks column.

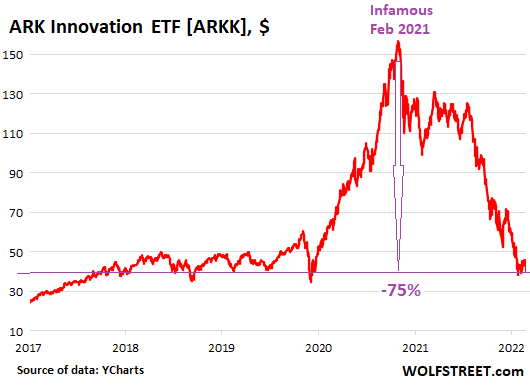

The Ark Innovations ETF [ARKK] is another indicator of when markets might approach the bottom, and we’re far from it.

The fund, which tracks a collection of ridiculous highfliers, dropped 7.1% on Friday and 9.7% for the week, to $40.11, above its 52-week closing low of May 11. The fund is down 75% from its high on February 16, 2021 – yes, that February 2021 – and is back where it had first been in May 2017.

Despite the losses, there are still many fervent believers in Cathie Wood and the miracles she’s going to perform with these highfliers that she thinks are offering ‘‘disruptive innovation’’ that “potentially changes the way the world works.” And as long as her funds are still kicking and are still attracting new money, we’re far from the bottom (data via YCharts):

And there will be huge rallies, and they will draw in more money, and it’s not until all this money has gotten incinerated, that we’re getting close to the bottom.

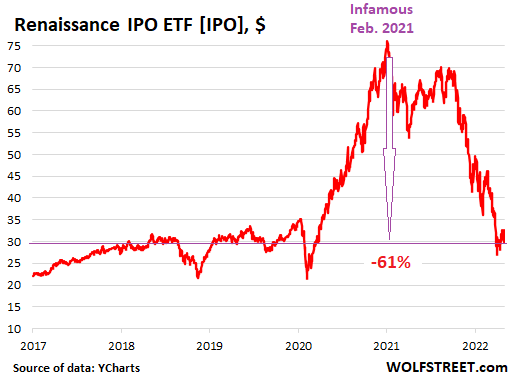

The Renaissance IPO ETF [IPO] dropped 4.5% on Friday and 7.9% for the week, is down 61% from its high on February 16, 2021, and is back where it had first been in May 2018 (data via YCharts):

Neither the Renaissance IPO ETF nor the Ark Innovation fund are old enough to have survived the dotcom bust or the Financial Crisis. They were formed a few years after the Financial Crisis in the era of money printing and interest rate repression and have never known anything else.

Now money printing and interest rate repression are gone, rates are moving higher, and QT has arrived. And we don’t know what the IPO ETF and Ark Innovation will look like when everything is said and done, but they might well end up on the landfill.

Ultimate bag-holder gamble: Why the bottom isn’t anywhere near.

So here’s Redbox again. The DVD rental company went public in October 2021 via merger with a SPAC at $10. The stock [RDBX] spiked to a high of $27.22, and then, in perfect SPAC tradition, kathoomphed 94% to $1.61 by February 24, 2022. This still makes sense.

But get this: On May 11, when Redbox was trading at $2.58, Chicken Soup [CSSE] offered to acquire it for 0.087 Chicken Soup shares per Redbox share. At the time, the acquisition price amounted about $0.69 per share, when Redbox was trading at $2.58 a share. Mmmkay.

It gets crazier – as dissected by Matt Levine on Bloomberg Opinion in an emailed note. Redbox’s controlling shareholder approved the deal. So when the acquisition closes, Redbox shareholders will get 0.087 Chicken Soup shares. That’s the deadline.

On Friday, Chicken Soup shares closed at $8.76, which means at this price, Redbox shareholders would get $0.76 per share when the deal closes.

Wait a minute… meme-stock jockeys have been driving up the price of Redbox, starting in mid-April, and on Friday, shares spiked by another 39% in regular trading and by 3.6% afterhours to $13.67. Since mid-April, the price multiplied by nearly 7.

But whoever ends up holding these shares when the acquisition closes will get 0.087 shares of Chicken Soup for each Redbox share, which today would amount to $0.76 a share. These ultimate shareholders would be the ultimate bag-holders.

The game is to drive Redbox shares up as far as possible and then for everyone to dump them before they end up as bag-holders with 0.087 Chicken Soup shares per each. And this will be a hilarious sight.

But the smart ones will dump it on the way up before everyone else is dumping them because when everyone is dumping them, it will be too late.

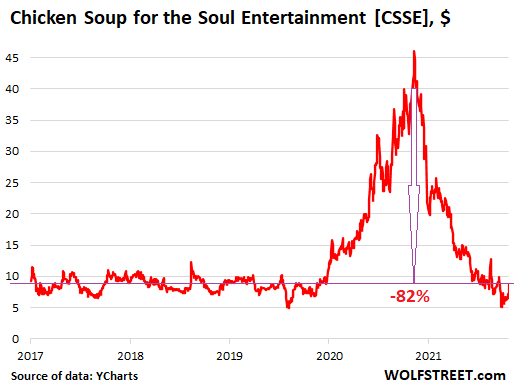

The other option for the meme stock jockeys is to also drive up Chicken Soup [CSSE]. On Friday, shares jumped by 19%, and for the week, they jumped by 35%, and over the past month, they jumped by 68%. But at $8.76 on Friday, they’re still down 82% from the high in June 2021, and at this price each bag holder would still only get $0.76 a share of Redbox that they paid $13.67 for today (data via YCharts):

And they all know that this is just a game of crazy-wild speculation, and it doesn’t matter whether it’s this kind of nonsense trade – and the efforts to gang up and manipulate that come with it – or cryptos, or whatever: The only hope is to find a greater fool to sell this stuff to because it’s just all a game.

And as long as this kind of crazy stuff keeps going on, the stock market rout is far from over, and there is still not a drop of blood in the street. There will be huge rallies, and they will draw more people in, and yes, some people already got wiped out, but not nearly enough to end the process of deflating the Everything Bubble.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

"stock" - Google News

June 12, 2022 at 09:07AM

https://ift.tt/s5ghyd6

Monday is Going to Be Interesting for Stocks - WOLF STREET

"stock" - Google News

https://ift.tt/ufPQUgB

https://ift.tt/stFdmyY

Bagikan Berita Ini

0 Response to "Monday is Going to Be Interesting for Stocks - WOLF STREET"

Post a Comment