Stocks fell on Wednesday as investors monitored signs of a potential economic slowdown and kept an eye on the bond market.

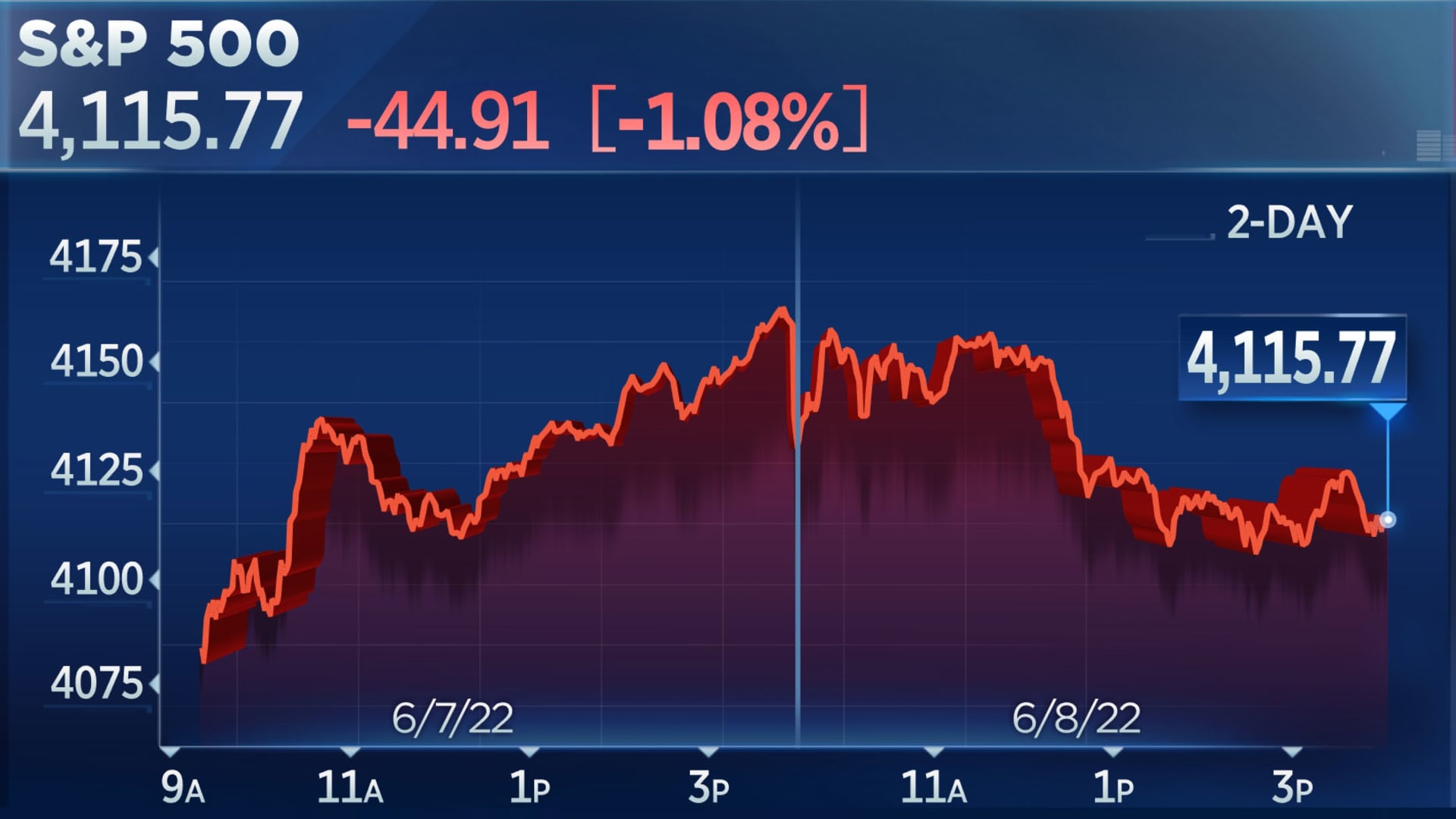

The Dow Jones Industrial Average shed 269.24 points, or 0.81%, to close at 32,910.90. The S&P 500 slid 1.08% to finish at 4,115.77, while Nasdaq Composite dropped 0.73% to 12,086.27.

The moves came as investors weighed updates from major companies and signs that economic growth may be slowing.

The U.S.-traded shares of Credit Suisse fell 1% after the bank issued a profit warning for the second quarter, citing tighter monetary policy and the war in Ukraine. Intel dropped more than 5% after management warned of weakening demand for semiconductors at an industry conference.

Meanwhile, the Atlanta Federal Reserve's GDPNow tracker shows a growth rate of just 0.9% for the second quarter, down from 1.3% last week. Mortgage demand hit its lowest level in 22 years last week, according to the Mortgage Bankers Association.

Deutsche Bank chief U.S. economist Matthew Luzzetti, who previously called for a recession by the end of 2023, said in a note to clients on Wednesday that the odds for a recession are likely to rise in the coming months.

"Our main conclusion is that forward-looking recession probabilities are likely to look far more sinister later this year as financial conditions tighten," Luzzetti wrote.

As the Fed continues to tighten monetary conditions, the concerns about economic growth and corporate earnings could have a bigger impact on stocks, Allianz chief economic advisor Mohamed El-Erian said on CNBC's "Squawk Box."

"The markets have been taking this news much better than they would have otherwise, but if I were fully invested right now, I'd take some chips off the table. I would wait for more value to be created," El-Erian said.

Action in the bond market may have hurt investor sentiment on Wednesday, as the 10-year Treasury yield jumped back above 3%. The price of oil also rose, with U.S. benchmark West Texas Intermediate crude pushing well above $120 per barrel.

Energy was a bright spot for the market, as the sector closed at its highest level since August 2014. Chinese tech stocks provided some support to the Nasdaq, with the U.S.-traded shares of JD.com and Pinduoduo rising about 7.7% and 9.7%, respectively.

Elsewhere, shares of Robinhood fell 3.9% after Securities and Exchange Commission Chair Gary Gensler detailed potential rule changes around trade execution, such as possibly requiring retail orders to be routed into auctions. Moderna rose nearly 2.2% after its modified Covid-19 booster shot showed a stronger response to new variants.

On the earnings front, Campbell Soup moved higher by about 1.5% after a stronger-than-expected quarterly report.

Investors are looking toward Friday's consumer price index reading for May. Many believe the print will be crucial for the path of Fed policy and whether the central bank will keep raising rates in half-point increments.

"We believe equity markets would likely rally at any hint of a pause in the expected rate-hike cycle. Positive consumer data could also help relieve some growth fears but, in some circumstances, could also further concerns that the Fed needs to get more aggressive to cool demand," Wells Fargo strategist Scott Wren said in a note to clients.

"Stock market rallies at this point will likely see headwinds and not meaningful follow through until there are clear signs the Fed is succeeding in controlling inflation," Wren added.

The stock market has had a roller-coaster year as the Fed's aggressive rate hikes stoked recession fears. The S&P 500 is off about 14% from its all-time high reached in January. The equity benchmark briefly dipped into bear market territory on an intraday basis last month. The tech-heavy Nasdaq, meanwhile, is down roughly 25% from its record high.

"stock" - Google News

June 08, 2022 at 05:02AM

https://ift.tt/0jq4zJu

S&P 500 falls 1% as investors gauge chances of economic slowdown - CNBC

"stock" - Google News

https://ift.tt/sZpFKqQ

https://ift.tt/1s2vVY9

Bagikan Berita Ini

0 Response to "S&P 500 falls 1% as investors gauge chances of economic slowdown - CNBC"

Post a Comment