Stocks lost ground in choppy trading on Friday as investors struggled to find a floor after a dramatic week that saw the Dow Jones Industrial Average post both its best and worst days since 2020.

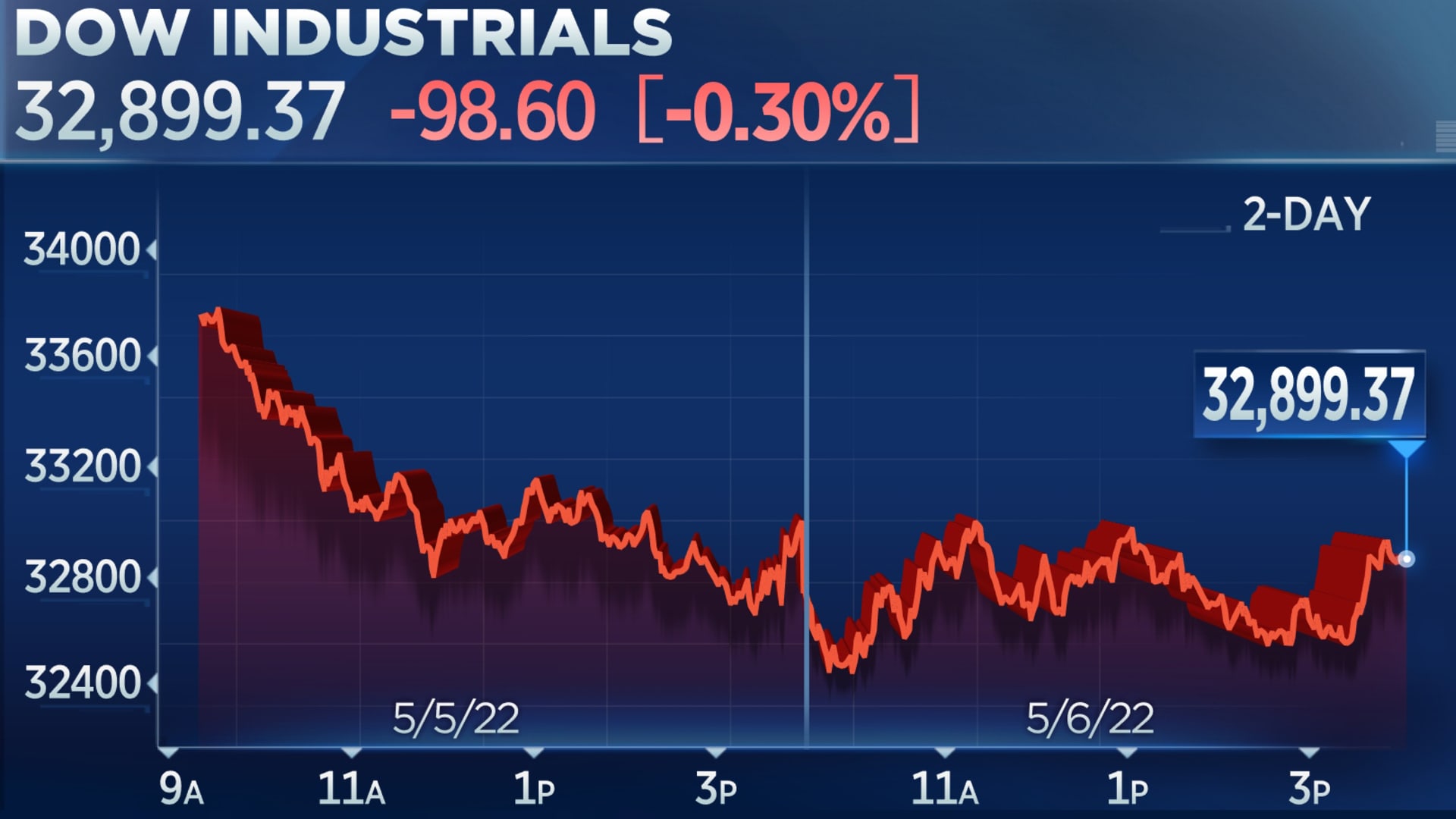

The S&P 500 shed 0.57% to close at 4,123.34, while the Nasdaq Composite fell 1.40% to settle at 12,144.66. The Dow shed 98.60 points, or 0.30%, to finish at 32,899.37. The losses on Friday clinched a losing week for all three major indexes despite starting off the period with three straight positive sessions.

The moves came after stocks sold off sharply on Thursday. The Dow lost more than 1,000 points, and the tech-heavy Nasdaq Composite fell nearly 5%. Both indexes notched their worst single-day drops since 2020. The S&P 500 fell 3.56%, its second-worst day of the year.

Thursday's losses erased Wednesday's big post-Federal Reserve meeting rally. Fed Chair Jerome Powell ruled out the prospect of larger rate hikes on Wednesday, sending the S&P 500 and the Dow to their best daily gains since 2020.

"The widely anticipated relief rally seen in equities and bonds post the 'less hawkish than feared' Fed on Wednesday was short lived," Barclays strategist Emmanuel Cau said in a note to clients. "Although aggressive 75bp hikes going forward may be off the table, the implied policy tightening cycle ahead is still very hawkish, in our view. Unless surging inflation quickly reverses its course (watch US CPI print next Wednesday), central banks may have no other choice than slowing growth to slow inflation and stay credible."

Tech stocks were again an area of weakness for the market on Friday. Amazon fell 1.4%, while Microsoft and Nvidia dropped about 0.9%. Netflix and Crowdstrike fell 3.9% and 8.9%, respectively.

Speculative areas of the market such as biotech and solar energy were hit hard on Friday. Illumina dropped more than 14%, while Enphase Energy fell 8.4%.

Tech was and underperformer for the market all week, e-commerce stocks in particular. Amazon and Shopify finished the week down roughly 7.7% and 11.6%, respectively.

"That underperformance that we have seen is directly tied to the rise in real yields, which are now in positive territory," said Angelo Kourkafas, an investment strategist at Edward Jones. "The issue with tech is not only the valuation pressures as the result of a different interest rate regime, but also there has been some pull-forward of demand. ... That's one of the key trends so far this earnings season."

For the week, the Dow finished down 0.24% for its sixth consecutive negative week. The S&P 500 and Nasdaq finished with losses of 0.21% and 1.54%, respectively, for their fifth straight losing week.

The Nasdaq closed about 25% below its record high from last November.

Moves in the Treasury market appeared to be affecting equities on Friday. The 10-year Treasury yield rose to 3.13% for the first time since 2018, coinciding roughly with the lows of the day for stocks, but eased back from that level later in the session.

Energy was a bright spot for the market, with EOG Resources jumping 7.1%. Oil prices rose again on Friday, which is a positive for energy stocks but is leading to worries about slowing economic growth and higher inflation.

On the earnings front, shares of Under Armour dropped more than 23% after the apparel company missed estimates on the top and bottom lines. That appeared to hurt rival Nike, whose shares dropped about 3.5% and weighed on the Dow.

Insurance stock Cigna jumped nearly 6% after a better-than-expected quarterly report.

The losses Friday came despite an April jobs report that showed a gain of 428,000 jobs, more than the 400,000 expected by economists surveyed by Dow Jones.

One weak area of the report was the labor force participation rate, which was little changed month over month and remains 1.2 percentage points below its pre-pandemic level. Economists believe that a recovery in participation could help stem the rise in wages and, by extension, inflation.

"If we are to get a soft landing, we are going to have to see a recovery in participation at a pretty rapid clip," said Luke Bartholomew, senior economist at Abrdn.

Elsewhere in economic data, the Fed's consumer credit data showed an increase of $52.4 billion in March, more than double what economists expected, according to Dow Jones.

— CNBC's Michael Bloom contributed to this report.

Looking for bargains amidst the selloff? Subscribe to CNBC Pro to see which stocks are most likely to rebound

"stock" - Google News

May 06, 2022 at 05:02AM

https://ift.tt/c2p4NSJ

Stocks fall on Friday to close out tumultuous week, Dow drops for sixth straight week - CNBC

"stock" - Google News

https://ift.tt/zbyPujL

https://ift.tt/EV7uPdH

Bagikan Berita Ini

0 Response to "Stocks fall on Friday to close out tumultuous week, Dow drops for sixth straight week - CNBC"

Post a Comment