Parradee Kietsirikul/iStock via Getty Images

The truth is rarely pure and never simple."― Oscar Wilde.

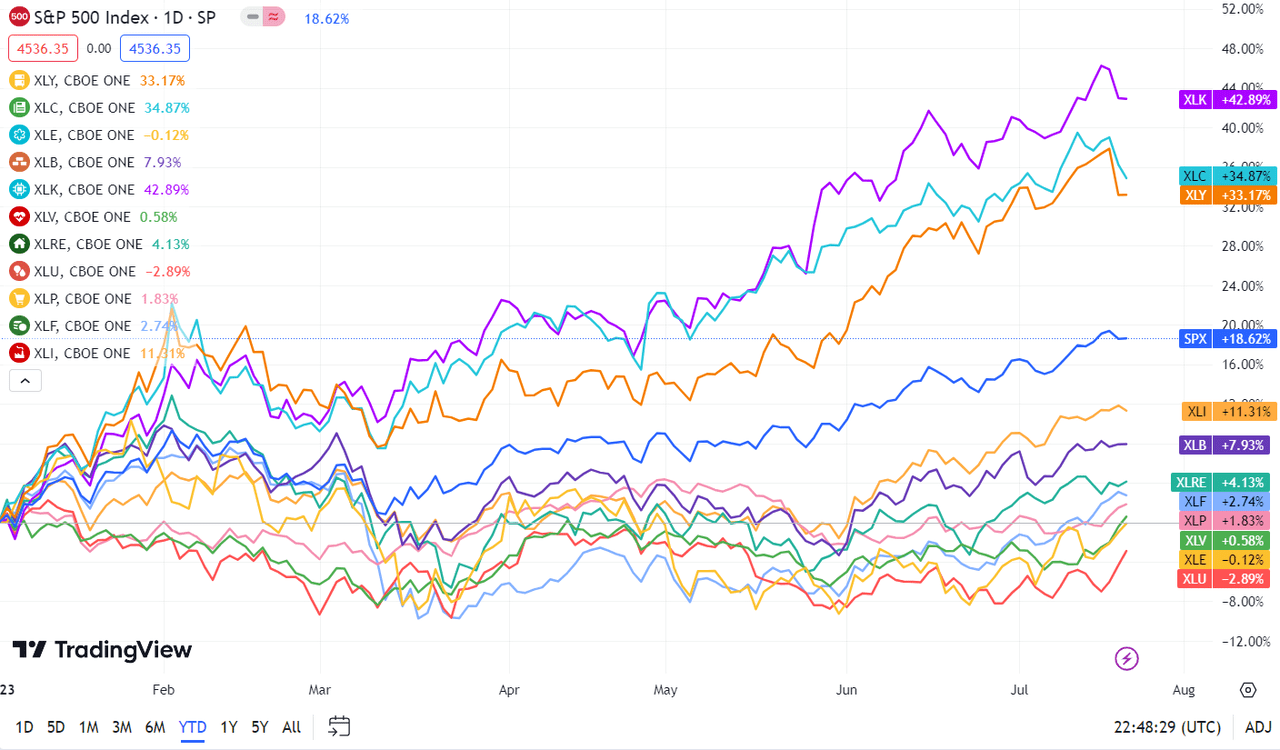

Today, we take our first look at Twilio Inc. (NYSE:TWLO), whose stock fell last week as Communications Services was one of the weakest sectors in the market with a loss of over three percent on the week.

Seeking Alpha

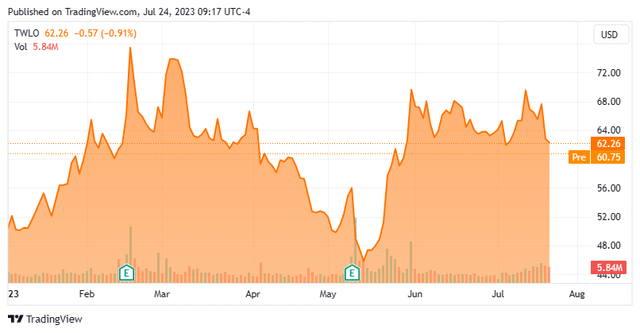

The stock initially fell hard when the company posted first quarter results in the second week of May. However, the shares have rebounded completely despite growing angst in the analyst community since then. With second quarter results two weeks out (expected post-market August 8), is the enthusiasm for the shares warranted? An analysis follows below.

Seeking Alpha

Company Overview:

This cloud-based concern is based in San Francisco, CA. The company operates a cloud communications platform that enables developers to build, scale, and operate customer engagement within software applications. Their Customer Engagement Platform or CEP allow clients to build direct, personalized relationships with their customers everywhere in the world. Roughly two-thirds of the company's sales come from the United States while the rest is from overseas. Most of the company's revenues are subscription based. The stock currently trades around $61.00 a share and sports an approximate market capitalization of just under $11.5 billion.

May Company Presentation

First Quarter Results:

The company reported its first quarter numbers on May 9th. The company had non-GAAP earnings of 47 a quarter, roughly a quarter a share about expectations. Revenues rose just over 14% on a year-over-year basis to $1 billion, in line with the consensus at the time. Active customers hit 300,000 in the quarter, up from 268,000 during the same period a year ago.

On the downside, Dollar-Based Net Expansion Rate fell to 106% in the quarter from 127% in 1Q2022. In addition, management provided 2Q2023 revenue guidance of $980 million to $990 million, approximately $20 million light at the midpoint of the range compared to the analyst consensus at the time. This would represent just four to five percent growth over 2Q20222 it should be noted. The stock fell some 15% quickly after earnings were posted, but almost as quickly regained those losses and moved higher.

May Company Presentation

Leadership believes it will deliver between $250 million to $350 million in non-GAAP net income in FY2023. However, Twilio does not project it will become profitable on a GAAP basis until FY2027, it should be noted. Twilio had a GAAP loss of $264.1 million for the first quarter. This included $121.9 million in severance and other expenses associated with a February restructuring and $21.8 million in lease impairment charges related to office closures.

May Company Presentation

Analyst Commentary & Balance Sheet:

First quarter results soured the analyst community on Twilio's near-term prospects. Robert W. Baird ($56 price target, down from $80 previously), Stifel Nicolaus ($50 price target) and Barclays ($50 price target) maintained Hold ratings on the stock after first quarter numbers came out. Piper Sandler downgraded TWLO to a Hold with a $71 price target. Today, RBC Capital downgraded the stock to an Under Perform with a $50 price target. Only Oppenheimer and Morgan Stanley ($75 price target, up from $65 previously) reissued Buy ratings on the share following quarterly results.

Approximately four percent of the outstanding float is currently held short. Numerous insiders have been frequent and consistent sellers of the stock for years. There are few insider purchases in the shares since the company came public in 2018. One notable exception was the CEO did buy $10 million worth of shares in February of this year. This purchase came two weeks after the company announced it was laying off 17% of its staff and closing some offices. Insiders have sold approximately $3.5 million worth of shares collectively since first quarter results posted.

The company ended the first quarter of this year approximately $3.3 billion of cash and marketable securities on its balance sheet against just over $400 million of long-term debt. In February of this year, management announced a $1 billion stock buyback authorization program, of which $500 million was calendared to be executed within six months of the new program.

Verdict:

The company lost 15 cents a share in FY2022 on revenues of $3.83 billion. The current analyst firm consensus has Twilio with a profit of $1.42 per share as sales climb seven percent. They see sales advancing 11% in FY2024 and the company delivering non-GAAP profits of $1.86 a share.

May Company Presentation

Year-over-year revenue growth has decelerated for many quarters now, and first quarter revenue fell slightly sequentially from the fourth quarter of last year. While leadership set a low bar for second quarter results and the company will turn profitable in FY2023, it is hard to find a compelling case to own TWLO at these levels.

Analyst support has crumbled on disappointing first quarter numbers, and the shares are price at over forty times forward earnings (on a non-GAAP basis) in a market with an overall S&P 500 (SP500) earnings multiple of 20. Therefore, I am passing on any investment recommendation on Twilio Inc. shares, as I could easily see TWLO stock retesting its post Q1 earnings low.

In a time of deceit telling the truth is a revolutionary act."― George Orwell.

"stock" - Google News

July 25, 2023 at 05:07AM

https://ift.tt/6yIDdUX

Twilio Stock: Vulnerable To Another Pullback (NYSE:TWLO) - Seeking Alpha

"stock" - Google News

https://ift.tt/LvlbVzf

https://ift.tt/a2h0AGd

Bagikan Berita Ini

0 Response to "Twilio Stock: Vulnerable To Another Pullback (NYSE:TWLO) - Seeking Alpha"

Post a Comment