shapecharge

Investment Thesis

I wanted to take a look at Workday Inc’s (NASDAQ:WDAY) financials to see if the flip to GAAP positive margins, along with the current share price is a good entry point for new investors. With an impressive turnaround of financials predicted going forward, the company is a very good candidate for a long-term position, however, if I was looking to start a position, the current risk profile is not to my liking, and I would wait for a slight pullback in share price.

Outlook

The company is making a lot of wins in recent quarters and the retention rate is very impressive over 95% as of Q1 ‘24. The company is providing a lot of value to its customers, and it shows through the strong double-digit revenue growth in its subscription services, which makes up around 90% of total revenues.

I always had a big gripe with non-GAAP measures and the company has been relying on them for a while now, so while I was working through the financial model of the company, I was very interested to see how it is going to improve its GAAP operating margins going forward. The company's non-GAAP operating margin has been very strong at around 23%, while GAAP, due to the stock-based compensation, was in the negatives. At first, I assumed that the company is going to keep going with SBC for a little while longer, however, to my surprise, the management is going to start to phase out the use of SBC and is expecting to reach around 22% of GAAP operating margins for the full FY24, as per the Q1 ’24 transcript.

The management is also pushing the ML/AI narrative that will improve efficiencies for years to come. The company is embedding AI and ML tools into its platforms, which should help operationally, “to rapidly deliver and sustain new ML-infused capabilities into our products to drive more business value for our customers”.

The company’s subscription revenues seem to be very sticky because of the value it can provide. Total Revenue Backlog is up 32% meaning there is plenty of revenue to be had in the upcoming months. If the company can continue to provide a solid service to its customers, the backlog should continue to grow and pay off for many years to come.

On the global front, the company has a lot of potential there because according to the Q1 ’24 transcript mentioned above, the company has barely penetrated 5% of the total addressable market [TAM]. With the continual expansion globally, the opportunity for high revenue growth is on the table, and seeing how the company performed in the past, I am confident that the management will be able to execute on that front also.

Overall, it seems like the company may be able to maintain strong growth in the coming years because of continuing expansion into other markets, and the total value it offers, which seems to be resonating with the customers, however, I will take on a slightly more conservative approach when valuing a company like WDAY.

Risks

It does look like I am quite optimistic about the company’s outlook, however, to balance things out I will add that the above assumptions of mine may not pan out the way I expect them.

The stock-based compensation may return once again, and the company becomes only non-GAAP profitable yet again, which I don’t like because it is not easy to model for the future.

The company’s expansion globally may not be as successful as I would think right now due to costs associated, which may be higher than in the US, with much more regulation, making the company lose more money.

Since the company has been losing money for the last decade, the company had to dilute its shareholders quite considerably, going from 171m in ’13 to 255m in FY23. This may continue in the future, however, the Board of Directors did recently authorize a $500m repurchase plan (10-Q report linked above), so that is a good start, and let's hope this trend continues. I would also not like them to repurchase shares at a premium, which I think the company is trading at right now, and rather use that cash flow to continue expanding its global footprint.

Briefly on Financials

As of Q1 '24, the company had around $6.3B in total liquidity, cash, and marketable securities against around $3B in long-term debt. I would usually not be a fan of having debt when the company is not making any operating profits, however, since WDAY is projecting to be GAAP operating income profitable going forward, I don't see an issue here. Besides, the company has been operating cash flow positive for a while now, while also having the interest income from massive $4.8B short-term investments.

The company’s current ratio is also right where I want the company to have it, which is around 1.5-2.0. It’s at around 1.9 right now, and anything above that I would think the company is not managing its cash pile too efficiently, but massive liquidity is great for the strategic expansions and upgrades the company is looking to make to its platform, which will enhance everything in the long run.

The company seems to be very healthy in terms of liquidity. The company would easily cover its short-term obligations if it had to all at once.

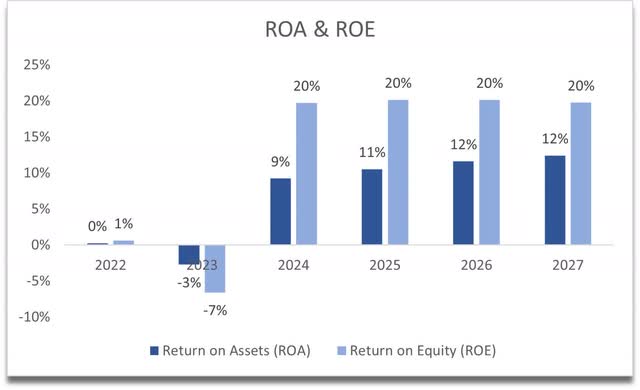

In terms of efficiency and profitability, we know that in the past, the company had bad ROA and ROE metrics because it was not making any GAAP profits, however, now that the company is looking to be GAAP positive, these will improve going forward. The below graph is what it might look like according to my model going forward.

ROA and ROE forecasts (Author)

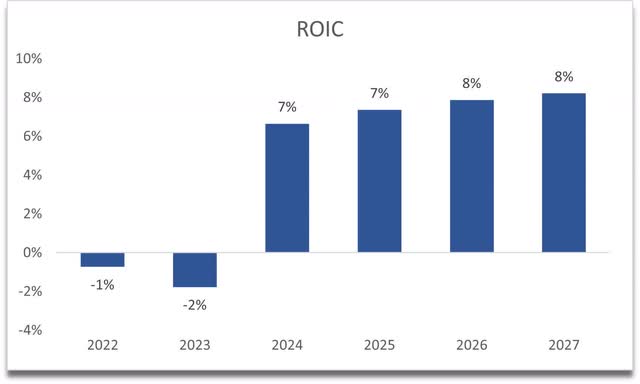

The same story can be said about the future competitive advantage and moat. ROIC has been negative, however, if the company improves over the next couple of years, the ROIC may look something like this:

ROIC forecast (Author)

Overall, strong cash position with manageable debt, and a promising future going forward on a GAAP basis, I could see the forecasts above play out that way, however, take it with a grain of salt as these are just my forecasts. It may not pan out that way.

Valuation

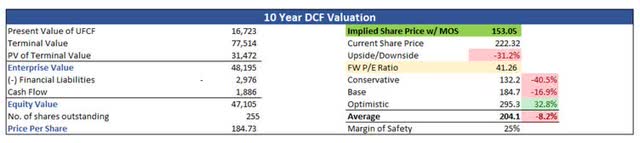

Over the last decade, the company has experienced a very respectable revenue growth of 34% per year. I decided to be more conservative, so I'm going to grow revenues for the base case at around 15% CAGR. For the optimistic case, I went with a 19% CAGR, while for the conservative case, I went with a 13% CAGR. I feel like these are more than achievable and are more on the conservative side.

In terms of margins, I improved gross and operating margins by a further 200bps from FY24 estimates.

On top of these assumptions, I’ll add another 25% margin of safety to the intrinsic value calculation. With that said, the intrinsic value of WDAY is $153.05, which means right now, it is a bit too expensive for my risk profile.

Intrinsic Value (Author)

Closing Comments

My take on the company’s outlook might be a little bit optimistic, however, to balance it out I used quite conservative estimates for growth and margins in my opinion. I really like the company and would like to add it to my portfolio but not at these prices. The earnings next month may bring some volatility to the stock price and if the company misses and it drops reasonably, I will look to open a position if it gets closer to my PT.

I believe the company has a bright future ahead and will continue its expansion successfully but for now, I'll sit on the sidelines and keep an eye out on how the story develops for the company. I'd like some bad news that could bring overreaction to the stock price so I could start a position, as long as the bad news is not actually bad news that would change the thesis completely.

"stock" - Google News

July 25, 2023 at 10:11AM

https://ift.tt/Qx4pcMU

Workday Stock: Good Company, But Wait For A Pullback (NASDAQ:WDAY) - Seeking Alpha

"stock" - Google News

https://ift.tt/LvlbVzf

https://ift.tt/a2h0AGd

Bagikan Berita Ini

0 Response to "Workday Stock: Good Company, But Wait For A Pullback (NASDAQ:WDAY) - Seeking Alpha"

Post a Comment