Stocks opened sharply lower Wednesday following two straight days of red-hot gains as yields on government bonds resumed their recent climb.

The 10-year Treasury yield jumped 13.6 basis points to 3.753% after today's round of data pointed to a resilient U.S. economy. (A basis point is equivalent to 0.01%.)

The economic reports released this morning included the ADP employment report that showed the U.S. added a higher-than-expected 208,000 private-sector jobs in September. Additionally, the Institute for Supply Management's (ISM) services purchasing managers' index slipped to 56.7% in September from the August reading of 56.9%. So while activity in areas such as restaurants and hotels slowed last month, it still remained exceptionally strong.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of Kiplinger’s expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of Kiplinger’s expert advice - straight to your e-mail.

The equity market's big moves higher on Monday and Tuesday "came on the back of multiple economic data points, all helping markets point towards a sooner-rather-than-later Fed pivot," says Stefanos Bazinas, execution strategist at the New York Stock Exchange. "Today's round of economic data, however, has reversed some of this Fed pivot optimism."

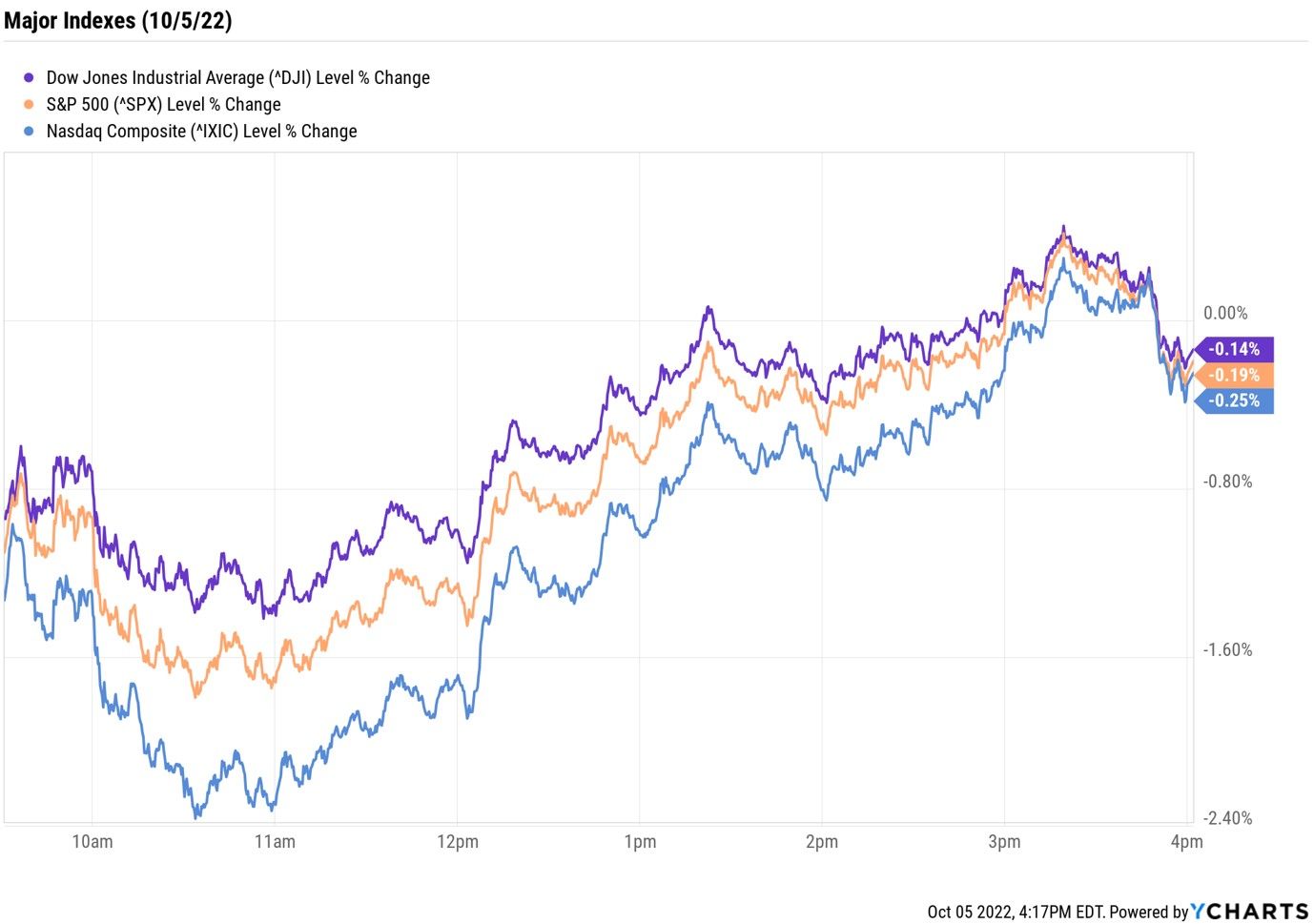

Still, despite that early selloff that saw major market indexes down between 1%-2%, all three finished well off their session lows. At the close, the Dow Jones Industrial Average was down 0.1% at 30,273, while the S&P 500 Index (-0.2% at 3,783) and the Nasdaq Composite (-0.3% at 11,148) ended with modest losses.

(Image credit: YCharts)

Other news in the stock market today:

- The small-cap Russell 2000 fell 0.7% to 1,762.

- Gold futures slipped 0.6% to settle at $1,720.80 an ounce.

- Bitcoin edged down 0.5% to $20,127.02. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Helen of Troy (HELE (opens in new tab)) jumped 3.3% after the consumer products maker, whose brands include Braun and Vicks, reported earnings. In its fiscal second quarter, HELE reported earnings of $2.27 per share on revenue of $521.4 million, beating analysts' consensus estimates.

The Pros' Favorite Oil Stocks

Energy stocks got a big boost today after OPEC+ issued its biggest supply cut since the early days of the pandemic. Specifically, the Organization of the Petroleum Exporting Countries and its allies said they will decrease production by 2 million barrels per day in an effort to buoy oil prices, which have been spiraling in recent months amid fears of slowing demand.

In reaction to the news, U.S. crude futures spiked 1.4% to $87.76 per barrel and the energy sector handily outperformed, jumping 2.1%. Today's move by OPEC marks a win for oil bulls – including Warren Buffett, whose Berkshire Hathaway (BRK.B (opens in new tab)) holding company has been steadily increasing its shares of Occidental Petroleum (OXY (opens in new tab)) in recent quarters – sparking rumors of potential buyout.

While Buffett is upbeat on Occidental, analysts are not, giving the stock a consensus Hold recommendation. But while OXY may not be one of the best oil stocks to buy now, according to Wall Street pros, these three names certainly are. Check them out.

"stock" - Google News

October 06, 2022 at 03:40AM

https://ift.tt/ObJQg2C

Stock Market Today: Stocks Close Lower After Roller-Coaster Session - Kiplinger's Personal Finance

"stock" - Google News

https://ift.tt/JMcgAlB

https://ift.tt/aNqGWSf

Bagikan Berita Ini

0 Response to "Stock Market Today: Stocks Close Lower After Roller-Coaster Session - Kiplinger's Personal Finance"

Post a Comment