A would-be bull market driven by a surge in artificial-intelligence stock market plays still feels like it has much in common with the run-up to recent collapses, argued Bank of America strategist Michael Hartnett in a Friday note.

Hartnett said he sees maximum upside for the S&P 500 of 100 to 150 points versus 300 points downside between now and Labor Day in September.

He wrote, “we are not convinced we at start of brand, new shiny bull market…still feels more like combo of 2000 or 2008, big rally before big collapse.”

The S&P 500 SPX, last week ended more than 20% above its October closing low, meeting a widely used criterion for the start of a bull market. The large-cap benchmark ended Thursday at its highest since April 2022 as it extended a daily winning streak to a sixth session.

The Dow Jones Industrial Average DJIA, ended Thursday at its highest since December, while the tech-heavy Nasdaq Composite COMP, saw its highest finish since April 7, 2022. Stocks pulled back modestly Friday, withe S&P 500 and Dow down 0.2% and the Nasdaq losing 0.5%.

The return to bull market territory comes as Wall Street analysts remain divided over the path ahead, reflected in a historically wide divergence between year-end S&P 500 targets.

Hartnett in February had forecast the S&P 500 to slide to 3,800 — a call that didn’t pan out as tech stocks took the lead to push the market higher. Last fall, Hartnett had

The strategist offered some humility, citing three reasons that bears like himself have been wrong in the first half of 2023: So far, neither an earnings nor an economic recession have occurred; the “credit crunch” threatened by the collapse of Silicon Valley Bank in March was “deftly averted” by the emergency liquidity response from the Federal Reserve and U.S. Treasury.

And third, the “unanticipated event” that shook markets in the first half wasn’t the collapse of SVB but the emergence of AI, he wrote.

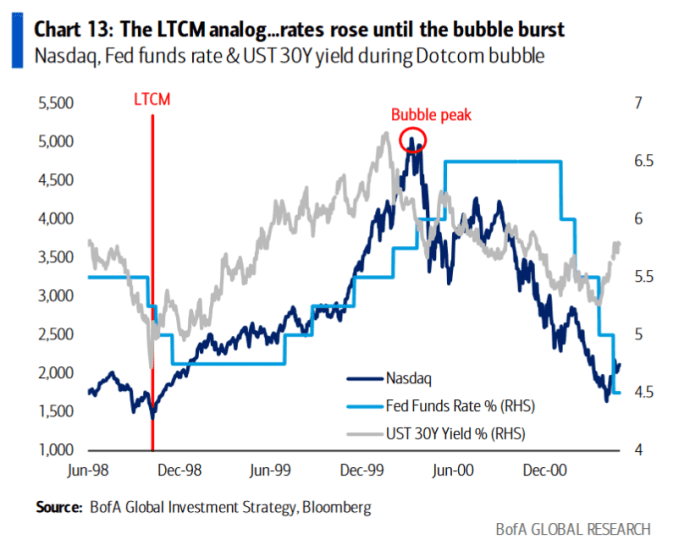

Hartnett argued that SVB, like the collapse of hedge-fund Long Term Capital Management in 1998, “ caused Fed easing and liquidity routed into the new secular growth theme of AI,” much like the LTCM collapse routed into the internet theme (see chart below).

As the “Magnificent 7″ megacap tech stocks drove the S&P 500 from 3,00 to 4,200, investors were forced to play catch-up as risks of a hard landing evaporated, Hartnett said.

While he awaits a big collapse, Hartnett said stocks can remain elevated until the Fed “reintroduces fear” by communicating the fed-funds rate needs to go to 6% to crack embedded inflation; long-term Treasury yields top 4% and real, or inflation-adjusted rates, rise to 2% to signal a tightening of financial conditions; and the U.S. unemployment rate rises above 4%, signaling recession.

Until then, investors remain likely to chase the market higher, rotating from momentum stocks to contrarian plays, “from deflation to inflation assets, from [developed market to emerging market] stocks, from no-landing plays to hard-landing plays,” he wrote.

"stock" - Google News

June 16, 2023 at 07:55PM

https://ift.tt/7h6IFt3

Big stock market rally to be followed by 'big collapse,' says BofA's Hartnett - MarketWatch

"stock" - Google News

https://ift.tt/d8ZC2gs

https://ift.tt/DbhtTJp

Bagikan Berita Ini

0 Response to "Big stock market rally to be followed by 'big collapse' says BofA's Hartnett - MarketWatch"

Post a Comment