An article published on Thursday by the Organised Crime and Corruption Reporting Project (OCCRP) revealed that substantial investments, amounting to millions of dollars, were channeled into publicly traded stocks of Adani Group through "opaque" funds based in Mauritius. These funds were found to mask the involvement of alleged business associates connected to the Adani family.

Based on the analysis of files from various tax havens and internal communications within the Adani Group, OCCRP, a nonprofit media organization, uncovered instances where investors utilized offshore structures to purchase and sell Adani stock.

The OCCRP article follows accusations made in January by US-based short-seller Hindenburg Research, alleging improper business dealings by the Adani Group. These included the utilization of offshore entities in tax havens like Mauritius, through which certain offshore funds were claimed to have "surreptitiously" held Adani's listed firms' stocks.

In response to the Hindenburg report, Adani Group denounced the allegations as baseless and lacking evidence, asserting its consistent adherence to legal frameworks.

The aftermath of the report resulted in a loss of $150 billion in market value for Adani Group stocks. Although the stocks have since recovered to some extent, regaining investor confidence after debt repayment, the overall loss remains at around $100 billion.

Adani Group provided a statement to OCCRP, indicating that the Mauritius funds in question had already been mentioned in the Hindenburg report, and dismissed the allegations as baseless.

“In light of these facts,these allegations are not only baseless and unsubstantiated but are rehashed from Hindenburg’s allegations,” the Adani group representative wrote. “Further, it is categorically stated that all the Adani Group’s publicly listed entities are in compliance with all applicable laws including the regulation relating to public share holdings.”

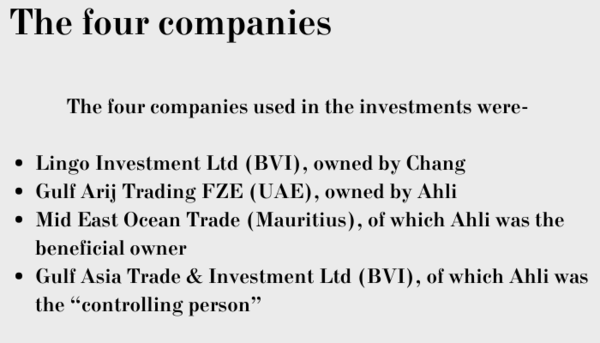

The OCCRP report identified two individual investors, Nasser Ali Shaban Ahli and Chang Chung-Ling, as subjects of investigation for their investments. OCCRP referred to them as "longtime business partners" of the Adani family. While no evidence linked their investments directly to the Adani family, OCCRP's documentation suggested coordinated trading activities. "Records show that the investment funds they used to trade in Adani Group stock received instructions from a company controlled by a senior member of the Adani family," the report said.

Neither Ahli nor Chang responded to OCCRP's requests for comment. In an interview with The Guardian, Chang denied knowledge of any secret Adani stock purchases, wondering why journalists were not more interested in his other investments.

(With inputs from agencies)

"stock" - Google News

August 31, 2023 at 08:15AM

https://ift.tt/4KbjIsY

'Adani family's partners used 'opaque' funds to invest in its stocks' - IndiaTimes

"stock" - Google News

https://ift.tt/xOwhWbk

https://ift.tt/x6Ufdz5

Bagikan Berita Ini

0 Response to "'Adani family's partners used 'opaque' funds to invest in its stocks' - IndiaTimes"

Post a Comment